BEYOND THE NUMBERS

As my latest post for US News & World Report explains:

[T]he headlines generated by two recent Congressional Budget Office (CBO) reports could lead policymakers to think they are in a damned-if-you-do-damned-if-you-don’t dilemma over their budget choices — reducing the deficit risks a recession; not reducing it leads to a dangerous and unprecedented debt explosion. But a closer read of the CBO reports says that if lawmakers have the will, they can find the way to avoid both.

One CBO report says that if we let all the scheduled tax and spending changes take effect in January, the resulting large reduction in the deficit would likely throw the economy into a recession in 2013. Our recent analysis cautioned that while the economy would “start down a slope that could ultimately lead to a recession in 2013 . . . that’s a far cry from the economy falling off a cliff and plunging immediately into recession.” Lawmakers would have a little time to put better policies in place.

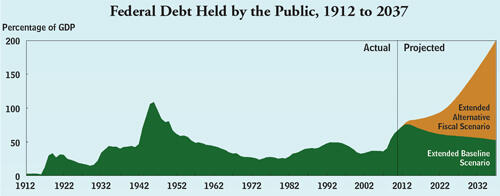

The other CBO report estimates that, without a politically sustainable deal to reduce long-term deficits, federal debt held by the public could rise to twice the size of the economy by 2037. (That’s the yellow “Extended Alternative Fiscal Scenario” in the CBO graph below.) So it would be a serious mistake to simply prevent January’s tax and spending changes from taking effect.

Source: Congressional Budget Office

So, what’s the solution? The first CBO report points out that lawmakers can “minimize the short-run costs of narrowing the deficit very quickly while also minimizing the longer-run costs of allowing large deficits to persist.”

sketches the beginnings of how they might do that:[A] cost-effective way to continue using the tax cuts to shore up the weak economy would be to extend the middle-class tax cuts for a year or two, allow the upper-income tax cuts to expire, and extend the tax-credit expansions targeted on low- and moderate-income households. Such an approach would provide the most “bang-for-the-buck” in terms of supporting the economic recovery in 2013-14 without seriously compromising long-term fiscal sustainability.