BEYOND THE NUMBERS

Our last post noted that support for expanding the Earned Income Tax Credit (EITC) for childless workers — as President Obama recommended last night — is growing on both sides of the aisle. Policymakers also should help low-wage workers by strengthening the minimum wage.

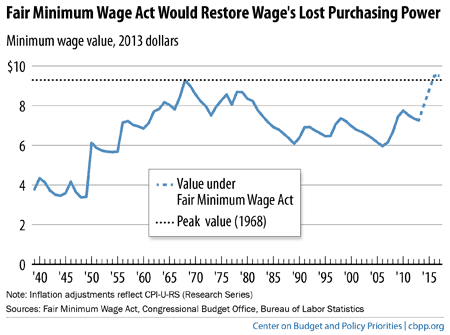

Today’s minimum wage is 22 percent below its late 1960s peak, after adjusting for inflation. Raising it to the $10-an-hour range would help to offset some of the unfavorable trends facing low-wage workers, including stagnant or falling real wages, too little upward mobility, and inadequate bargaining power that leaves them solidly on the “have-not” side of the inequality divide.

The President last night announced an executive order to raise the minimum wage for workers on government contracts to $10.10, thereafter indexed to inflation. That’s a good first step, as I explain here.

The increase is modeled on a proposal before Congress — the Fair Minimum Wage Act of 2013 (FMWA) — to raise the minimum wage from $7.25 to $10.10 in three annual increments and then index it to inflation. If policymakers enact the FMWA soon, by 2016 the value of the minimum wage (adjusted for inflation) would be slightly above its late 1960s peak, as the graph shows.

The question of whether raising the minimum wage reduces employment for low-wage workers is one of the most extensively studied issues in empirical economics. The weight of the evidence is that (1) for minimum wage levels in the range now being discussed, such impacts are small, and (2) minimum-wage increases of the size enacted in the past, and under the proposals now being discussed, are a net benefit to low-wage workers as a group. Raising the minimum wage also would modestly lower poverty and help push back against rising inequality.

Some opponents of raising the minimum wage argue that it would primarily benefit teenagers working for extra money, but the large majority of those who would benefit are adults, most of them women. Indeed, the average worker who would benefit brings home half of the family earnings. This reflects the fact that the low-wage workforce has gotten older (and more educated) in recent decades.

In addition, though opponents often suggest that the EITC obviates the need for a minimum-wage increase, both a strong EITC and an adequate minimum wage are needed to ensure that work “pays” for those in low-wage jobs. The two policies are complements, not alternatives.

To lift working families’ incomes to an adequate level through the minimum wage alone, policymakers would have to raise it far above its historical level — and to a level that could raise significant concern about the effect on jobs.

Similarly, if policymakers tried to do the job solely through refundable tax credits like the EITC, the cost to the government would be well beyond what they likely would countenance. Also, low-income workers would get too large a share of their income once a year at tax time, rather than throughout the year in their paychecks.

Working together, however, a decent minimum wage and strong refundable credits can help low-wage workers make ends meet and ensure that those considering whether to work have a strong incentive to take a job.