BEYOND THE NUMBERS

With President Obama and lawmakers of both parties vowing to achieve further deficit reduction, the stakes are high for low- and moderate-income Americans. Moreover, as we explain in a new paper, if deficit reduction targets programs that provide supports and foster opportunity for low-income families, the adverse effects could be felt for decades — and not just by the low-income families and individuals who receive this assistance.

The economy’s future strength will depend in part on tapping the talents of as many Americans as possible. If we shortchange investments that expand opportunity, the nation and our economy will be weaker than otherwise. As recent data and research show, various key federal programs both ameliorate poverty in the short run and have important positive impacts over the long run.

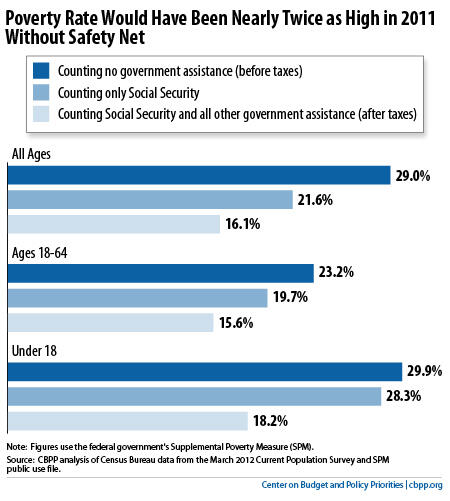

Census data show that, as a group, programs that help families struggling to afford the basics are effective at substantially reducing the number of poor and uninsured Americans.

Overall, public programs lifted 40 million people out of poverty in 2011, including almost 9 million children (see chart). While Social Security lifted the largest number of people overall out of poverty, the Earned Income Tax Credit (EITC) lifted the largest number of children. Together, the EITC and Child Tax Credit (CTC) lifted 9.4 million people — including nearly 5 million children — out of poverty in 2011.

In addition, Medicaid provided access to affordable health care to more than 60 million people in 2009; thanks to Medicaid and the Children’s Health Insurance Program (CHIP), children are much less likely to be uninsured than adults.

Some leading researchers in the field have conducted a comprehensive review of the available research and data on how safety net programs affect poverty. They found that the safety net lowers the poverty rate by about 14 percentage points (even after accounting for any potential negative effects on work incentives, which the research finds to be small). In other words, one of every seven Americans would be poor without the safety net. That translates into more than 40 million people.

Policymakers can make some money-saving changes in programs for low- and moderate-income individuals or families without unduly burdening those populations. But the achievable savings through greater efficiencies in means-tested programs are modest. In particular, the largest means-tested program — Medicaid — already provides health care coverage at a substantially lower cost per beneficiary than private coverage.

A more balanced approach to deficit reduction that includes adequate new revenues to complement additional spending cuts can further reduce deficits while maintaining the resources to invest in key building blocks of future prosperity, including effective services and supports for poor families and children.

We’ll take a closer look at how the safety net supports work and its positive long-term effects in future posts.

Click here to read the full paper.