The House Ways and Means Committee today passed legislation to make six corporate tax cuts permanent, largely along party lines. These tax cuts, whose benefits ultimately accrue largely to higher-income households, have been the subject of intense corporate lobbying efforts. But while the Committee acted on these tax breaks, they ignored the fate of key tax credits that help millions of working families struggling to make ends meet.

The six corporate tax cuts — with a $301 billion price tag over 2015-2024 — are part of a larger group of mostly corporate tax breaks known as extenders, because they’re traditionally extended for only one or two years at a time.

While the Ways and Means leadership rushed to make these tax breaks permanent, they ignored much-needed extensions of key provisions of the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) that boost millions of working families’ incomes while strengthening work incentives. These provisions will expire at the end of 2017 unless Congress acts. If that happens, many low-income working families will lose all or part of their CTC, marriage penalties will go up for many working married couples, and many working families struggling to raise more than two children will see their EITC fall.

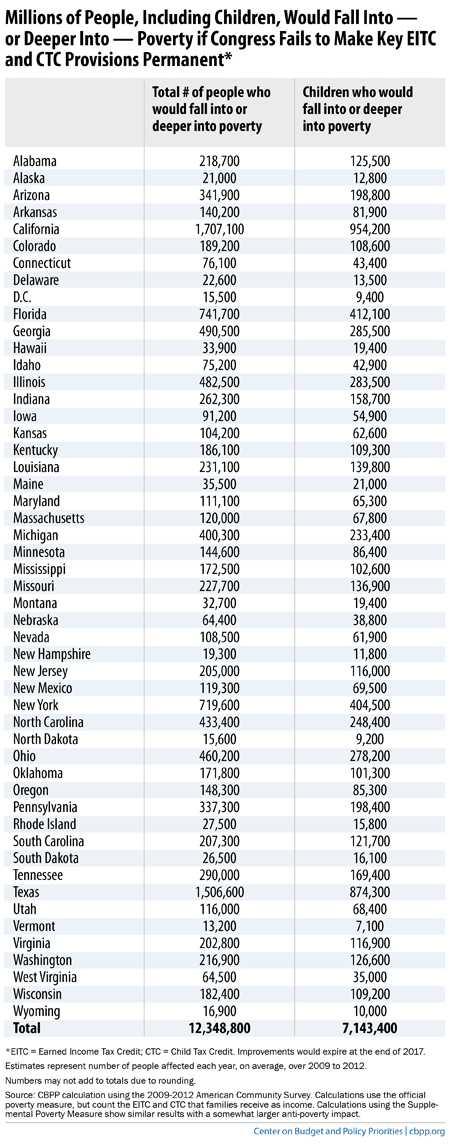

In fact, as the table below shows, allowing these critical improvements to the CTC and EITC to expire would mean that about 12 million people nationwide, including 7 million children, would fall into or deeper into poverty.

Keeping these working families from falling into or deeper into poverty should be a higher priority than making corporate tax cuts, including one tax break for overseas profits of Wall Street banks, permanent. As lawmakers continue to debate which expiring tax provisions to make permanent, the EITC and CTC improvements — and the millions of workers and children they help — should be at the top of the list, not left behind.