BEYOND THE NUMBERS

Thanks to Medicare, which turns 47 next Monday, seniors are the one group of Americans with nearly universal health coverage. Almost all Americans (see slide 19 of this recent Kaiser tracking poll) think that Medicare is important, and few support radically changing it to reduce deficits. But, without a balanced deficit-reduction package that includes significant revenue increases, that could easily happen.

Budget analysts generally agree that we must reduce deficits by roughly $3 trillion over the next decade to stabilize the debt as a share of the economy. That’s in addition to the $1.6 trillion in spending cuts over the next decade that policymakers enacted in 2011.

Medicare should certainly contribute to further deficit reduction, just as it has contributed to every major deficit-reduction effort in recent decades. Policymakers, however, must design changes to Medicare carefully in order to avoid undermining its ability to protect vulnerable seniors and persons with disabilities against high health care costs.

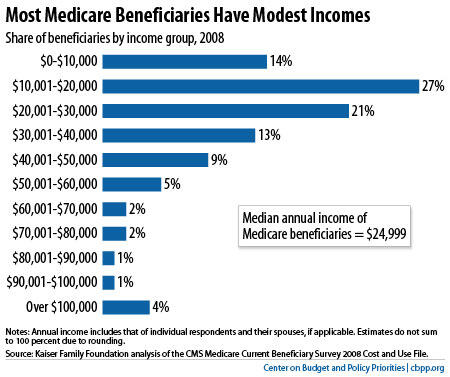

Few Medicare beneficiaries live on Easy Street. Half have incomes below $25,000, and only 15 percent have incomes above $50,000 (see figure). Furthermore, they spend much more of their budgets on out-of-pocket health care costs than other Americans — 15 percent, on average, compared to 5 percent for everyone else.

Reducing deficits almost entirely by cutting programs, with little or no new revenues, would likely require deep and harmful cuts in Medicare. The House-passed budget plan from Budget Committee Chairman Paul Ryan (R-WI) illustrates the danger.

The Ryan budget would replace Medicare’s guarantee of coverage with a voucher that beneficiaries would use to buy coverage in the private market. It would also raise Medicare’s eligibility age from 65 to 67 and reopen the “doughnut hole” in Medicare’s coverage of prescription drugs, which the health reform law is gradually closing. Together, these changes would shift substantial costs to Medicare beneficiaries.

At the same time, the Ryan budget includes big cuts in other programs, especially those for low-income Americans, and stunning new tax cuts for the wealthy.

Medicare supporters thus need to pay careful attention to the ongoing budget debates. Medicare beneficiaries with modest incomes should not have to pay the price of tax cuts for those at the top.