BEYOND THE NUMBERS

Social Security benefits may be on the chopping block as policymakers tackle the nation’s long-term fiscal challenges. But before sharpening the ax, policymakers need to keep five key facts in mind, as we explain in a new report:

- Social Security benefits are modest. The average benefit for the “big three” groups of recipients — retired workers, disabled workers, and aged widows — is only about $1,100 a month, or $14,000 a year. Over 95 percent of beneficiaries get less than $2,000 a month.

- Most beneficiaries have little significant income from other sources. Social Security provides nearly two-thirds of income for beneficiaries 65 and older, on average, and it’s the only source of cash income for about a fifth of elderly beneficiaries. The median household income for all elderly beneficiaries, including their Social Security benefits, is only about $20,000 a year.

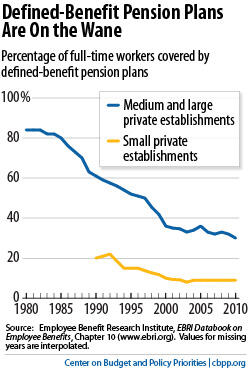

- For most seniors, Social Security will be the only source of income that’s guaranteed to last as long as they live and to keep up with inflation. Coverage under employer-sponsored, defined-benefit pension plans — a traditional mainstay of retirement income — has fallen precipitously (see graph). Many firms have switched to defined-contribution plans that shift the financial risks to their employees.Image

As Americans try to stretch their savings in 401(k)s or other accounts (which can produce volatile and uncertain returns) to cover their full lifespan (whose length they can’t predict), preserving Social Security’s guarantee of lifetime, inflation-adjusted income will become even more important.

- Social Security benefits in the United States are low compared with other advanced countries. Governments around the world are feeling fiscal pressure, and some are adopting austerity programs that trim retirement benefits. Why, some commentators ask, should the United States be different? Here’s one reason: most other developed countries have more generous public-pension systems than the United States. The Organisation for Economic Cooperation and Development has tallied the percentage of past earnings that the public-pension system replaces for various workers, and for a median worker, the U.S. ranks 26th out of the 30 OECD nations.

- Future retirees already face a squeeze from a rising Social Security retirement age (which amounts to an across-the-board cut in benefits) and escalating Medicare premiums. Many financial planners advise their clients to aim for a retirement portfolio — from Social Security, pensions, and savings — that will replace 70 percent of their pre-retirement income. Social Security will get them only partly toward that goal.

For a medium worker (earning about $43,000 in 2010 dollars) who retires at age 65 today, Social Security replaces only about 37 percent of previous earnings, after subtracting Medicare premiums. And that figure will slip as the program’s age for full benefits (sometimes called the “normal retirement age”), which climbed from 65 to 66 in the past decade, rises further to 67 for people born in 1960 and later and Medicare premiums take a bigger bite. By 2030, that retiree’s check will replace just 32 percent of past earnings, after subtracting Medicare premiums.

All of those facts argue for limiting any cuts in future benefits — a position that the majority of the public appear to support.