BEYOND THE NUMBERS

Unemployment’s Down, But More Unemployed Workers Lack Jobless Benefits

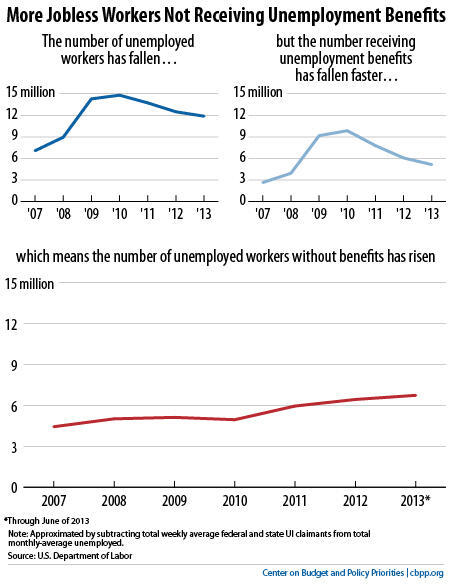

Our last post explained that SNAP enrollment is still high because the job market is still weak. Here’s another reason why the need for SNAP remains high: while the number of unemployed workers has fallen since 2010, the number who receive no state or federal unemployment insurance (UI) benefits has risen and is higher now than at the depths of the recession (see graph). These jobless workers are the most likely to qualify for SNAP because they have neither wages nor UI benefits.

As our new paper explains:

In 2009, when the economy hit bottom and the unemployment rate peaked, 14.3 million workers were officially unemployed and 9.2 million of them received UI benefits — leaving 5.1 million jobless workers with no UI benefits. In the first half of 2013, there were fewer officially unemployed workers — 11.9 million. But there were more unemployed workers not receiving UI benefits — an estimated 6.7 million. In other words, the number of unemployed workers who are in the worst shape because they have neither wages nor unemployment benefits is greater now than at any previous point in many years. . . .

A smaller share of unemployed workers now receive UI for several reasons. One is the length and depth of the protracted jobs slump, which has left many workers unable to find work before their UI benefits run out. In addition, a number of states have cut the number of weeks of regular, state-funded UI benefits in recent years; these changes also shorten the number of weeks of federal UI benefits a person can subsequently receive.

In addition, the duration of federal UI benefits (which go to long-term unemployed workers) has fallen. This reflects several factors. One is the decline in the official unemployment rate in many states, which itself leads to automatic reductions in the number of weeks of federal Emergency Unemployment Compensation benefits available in those states.

Another factor is federal changes implemented in 2012 in the number of weeks of federal UI benefits provided irrespective of improvements in economic conditions.

A third factor is the disappearance from every state except Alaska of another source of long-term UI benefits, the federal Extended Benefits program (which is designed to “trigger on” automatically when a state’s unemployment rate is rising rapidly, but under the same formula, ceases to remain available once unemployment stops rising even if the state continues to experience a long period of severely elevated unemployment).

As our paper explains, if the job market improves, SNAP enrollment and costs should come down. In fact, the Congressional Budget Office (CBO) projects that as the labor market recovers, SNAP costs will decline markedly. CBO projects that by 2019, SNAP costs will fall all of the way back to their mid-1990s level, measured as a share of the economy.