off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

Three Charts on the Coming Budget Debate

| By

CBPP

As policymakers and the public turn their attention from the election campaign to the nation’s long-term budget challenges, here are three related CBPP reports that give some context for the coming debate:

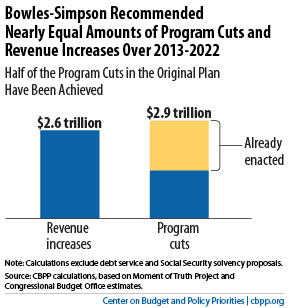

- $2 Trillion in Deficit Savings Would Achieve Key Goal: Stabilizing the Debt Over the Next Decade. Some budget watchers are urging the President and Congress to enact $4 trillion in savings over the next ten years in order to address the deficit problem. The $4 trillion figure has assumed something of a life of its own. In fact, there is no single magic number. For example, policymakers could achieve the most essential goal — stabilizing the public debt over the coming decade (that is, ensuring that the debt doesn’t rise faster than the economy and, thus, risk eventual economic problems) — by enacting $2 trillion in savings (see first chart). This $2 trillion would be on top of the budget cuts Congress has already enacted; see the next point.

Image

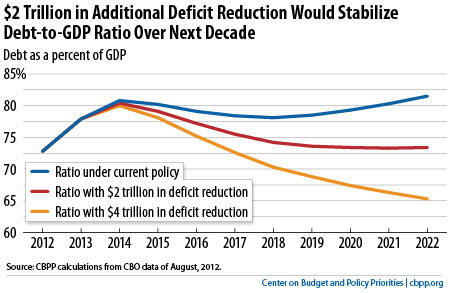

- Congress Has Cut Discretionary Funding By $1.5 Trillion Over Ten Years. Debates over how — and how much — to reduce projected deficits often overlook the fact that the first stage of large-scale deficit reduction is already in law. Legislation enacted last year, most notably the Budget Control Act, will produce $1.5 trillion in savings in discretionary (that is, non-entitlement) spending for fiscal years 2013 through 2022. These cuts will shrink non-defense discretionary funding — which includes an array of domestic programs ranging from education to law enforcement, food safety, and environmental protection, as well as international programs — to its lowest level on record as a share of GDP, with data going back to 1976 (see second chart). The enactment of these budget cuts is one reason that an additional $2 trillion in deficit reduction, rather than some bigger number, would be sufficient to stabilize the debt ratio. (See the bullet above.)

Image

Update, November 9: we’ve updated this graph as explained here.

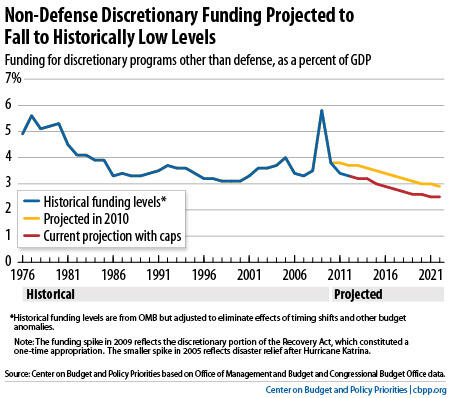

- What Was Actually in Bowles-Simpson — and How Can We Compare it With Other Plans? While many policymakers have expressed support for the budget plan that Erskine Bowles and Alan Simpson issued in December 2010, a number of policymakers and opinion leaders do not understand what the plan actually included.When looked at over fiscal years 2013-2022, the period covered by current budget plans, Bowles-Simpson called for $6.3 trillion in deficit reduction: $5.5 trillion in policy savings and about $800 billion in interest savings. The policy savings consist of 53 percent program cuts (totaling $2.9 trillion) and 47 percent revenue increases (totaling $2.6 trillion), or almost a 1-to-1 ratio (see third chart).Policymakers have already enacted about half of Bowles-Simpson’s program cuts, as we discussed in the second point, above. Thus, most of the plan’s not-yet-achieved savings are on the revenue side. Excluding the enacted savings, Bowles-Simpson would achieve an additional $4.6 trillion in deficit reduction over ten years, consisting of $1 in program cuts for every $2 in revenue increases. This $4.6 trillion in additional deficit reduction is more than twice what’s needed to stabilize the debt as a share of the economy; as we discussed above, $2 trillion in additional deficit reduction would be sufficient to stabilize the debt.Image

Topics:

Stay up to date

Receive the latest news and reports from the Center