BEYOND THE NUMBERS

In an excellent post on the latest IRS data on the 400 highest-income taxpayers, the Tax Policy Center’s Roberton Williams cites F. Scott Fitzgerald’s famous quote — “Let me tell you about the very rich. They are different from you and me” — and then shows just how different. With an average income of $270 million in 2008, the typical household in the Top 400 made 4,700 times as much as the average American filing a 1040 form.

Congressional Republican leaders are trying to put a new twist on how the very rich are different. By seeking to reduce long-term deficits entirely through huge budget cuts that fall disproportionately on low-income programs — rather than a balanced package of budget cuts and tax increases — they are effectively arguing that wealthy Americans shouldn’t have to sit with other Americans at the table where sacrifices will be made.

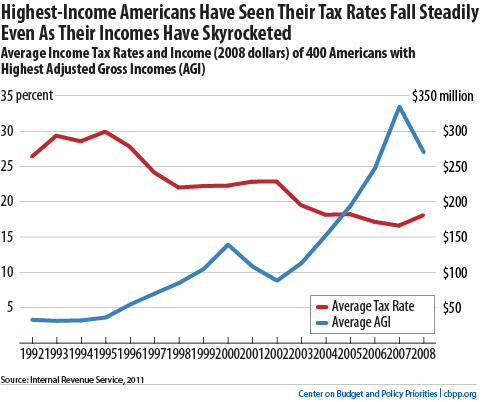

As the chart shows, the top 400 have enjoyed the best of both worlds over the past couple of decades: dramatically higher incomes and much lower taxes. Between 1992 and 2008 (the period the IRS data cover), the average share of their incomes that these households paid in federal taxes dropped from 26 percent to 18 percent, while their annual incomes shot up by over 700 percent, after inflation. And still, Republican leaders insist that wealthy Americans shouldn’t pay a penny more in taxes.

At the same time, GOP leaders have reserved seats at the budget-cutting table for many Americans who are in a poor position to make significant sacrifices. Here are a few examples of the kinds of people who could face serious harm under the House-passed budget:

- An elderly woman who relies on Medicaid to help cover her nursing home costs. The House budget would cut federal Medicaid funding by $771 billion over the next ten years.

- A 50-year-old plumber who has assumed he would have guaranteed health coverage under Medicare when he retires. The House budget would replace Medicare with vouchers that would fall farther and farther behind the cost of health insurance.

- A working-class girl who will need a Pell Grant to afford college. The House budget would slash Pell Grant funding,

The House budget also would set federal spending on a path that would nearly eliminate most of the federal government other than Social Security, health care, and defense by 2050, leaving very few resources for everything from education to environmental protection, food safety, and medical research. The resulting cuts could have serious consequences for millions of Americans; one possible example is people with diabetes, hypertension, or cancer hoping to benefit from National Institutes of Health research.

To call for sacrifices like these from average Americans, while rejecting any tax increases on the people with the highest incomes, reflects an extreme set of priorities — and not one that most Americans share.