off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

The Need to Rebalance Federal Housing Policy, Part 4: How a Renters’ Credit Could Work

| By

Will Fischer

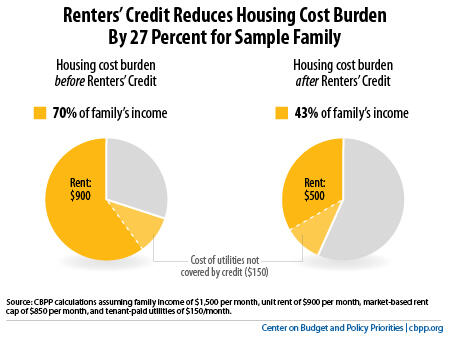

As we explained in yesterday’s post, current rental assistance programs reach only a fraction of families in need. A federal

could help fill some of that gap. Here’s how it would work: Congress would create the credit, which it could cap at $5 billion a year, and finance through the reform of homeownership tax deductions. The federal government would then give each state authority to distribute a certain amount of credits. Families assisted with credits would generally pay 30 percent of their income for rent, and property owners (or sometime banks that lend to them) would receive credits on their federal tax returns in exchange for rent reductions. Credits totaling $5 billion per year would reduce housing costs substantially — by an average of $400 — for 1.2 million low-income renter households (see graph).Image

Topics:

Stay up to date

Receive the latest news and reports from the Center