BEYOND THE NUMBERS

The Myth of the Exploding Federal Government, Part 1

Two sets of negotiations on Capitol Hill — on the budget’s spending and tax priorities and on the Farm Bill, which includes renewing SNAP — raise important questions about the size and role of government. People who believe that future deficit reduction must come solely from spending cuts sometimes claim that the federal government is exploding in size. Similarly, people who favor big cuts in safety net programs like SNAP sometimes claim that these programs are growing out of control. We’ve updated two papers showing that the data don’t support either the first claim or the second one.

Let’s look at the first claim first. (We’ll address the second in part 2.) While total federal spending as a share of the economy rose considerably in the recession, it has already fallen dramatically from its 2009 peak.

If we continue current policies, federal spending outside of interest payments on the debt is projected to decline in the decade ahead as the economy recovers. In fact, this spending (which analysts call “primary outlays”) has already fallen from 23.9 percent of gross domestic product (GDP) in 2009 — at the bottom of the recession — to a projected 20.2 percent of GDP in 2013. It is projected to fall further, to 19.5 percent of GDP or lower in the latter part of this decade.

While total federal spending will remain high throughout the coming decade under current policies, that’s mostly because of a marked increase in interest payments. In particular, as the economy recovers, interest rates will also rise, simultaneously increasing the interest we must pay on any given amount of debt.

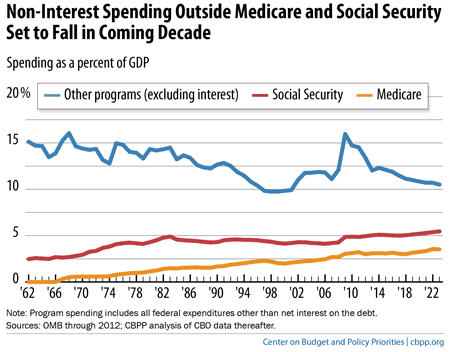

Total non-interest spending outside of Social Security and Medicare — two programs whose costs are driven up by the aging of the population and the rise in health care costs throughout the U.S. health care system — will fall well below its 50-year historical average in the decade ahead.

By 2023, it will fall to 10.5 percent of GDP, compared to an average over the 1963-2012 period of 13.0 percent. These figures do not count any spending cuts from the sequestration required under the Budget Control Act after fiscal year 2013; if those cuts are counted, non-interest spending outside Social Security and Medicare will fall even further below the historical average.