BEYOND THE NUMBERS

Any evaluation of the recent “fiscal cliff” budget deal needs to consider its impact on one of the most powerful and troubling economic trends of recent decades: the sharp rise in income inequality. The deal shifts tax policy in a favorable direction by raising taxes on the nation’s highest-income people, but the increase is modest when compared to the effects of growing inequality.

Average after-tax income, which in the Congressional Budget Office’s (CBO) comprehensive measure also includes government benefits like Social Security, rose by more than 150 percent for the top 1 percent of households between 1979 (the first year for which these CBO data are available) and 2009 (the most recent year available). That’s more than three times the 44 percent gain for the average household in the middle fifth of the income scale. (Note: incomes were atypically low for the highest-income households in 2009 because of the financial crisis; evidence suggests that they had already begun to rebound in 2010.)

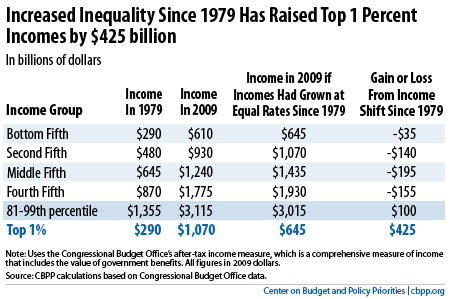

One way to look at the impact of this unequal growth is to see how it affected the total amount of income that the top 1 percent and other income groups had in 2009 — compared to what they would have had if the income of every group had grown at the same rate since 1979 (see table). And, again, these figures reflect the impact of taxes and government benefits, like unemployment insurance, SNAP (food stamps), Social Security, and Medicaid.

- We calculate that the top 1 percent of households had $1.07 trillion in total income in 2009, which is $425 billion more than they would have had if incomes of all groups had grown at an equal rate over the 1979-2009 period.

- Each of the bottom four income groups, in contrast, had less total income than if all incomes had grown at an equal rate. The middle fifth of households, for example, had $195 billion less.

Now consider the impact of the fiscal cliff deal. Compared to a full extension of the Bush tax cuts, it will raise taxes (and lower after-tax incomes) by about $60 billion a year from people in the top 1 percent.

That’s a beneficial change, but a modest one.