BEYOND THE NUMBERS

Research by economists Bruce D. Meyer of the University of Chicago and Dan T. Rosenbaum of the University of North Carolina at Greensboro found that EITC expansions between 1984 and 1996 were responsible for more than half of the large increase in employment among single mothers during that period. The biggest gains in employment attributable to the EITC were for mothers with young children and mothers with low education levels.

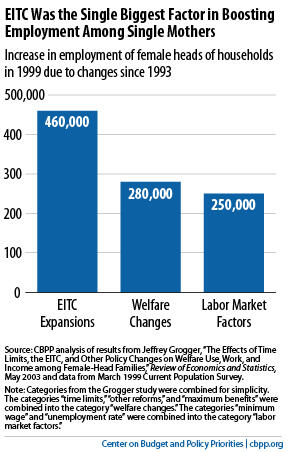

Even more striking, a highly regarded study by University of Chicago economist Jeffrey Grogger found that the EITC expansions enacted in the 1990s “appear to be the most important single factor in explaining why female family heads [of households] increased their employment over 1993-1999.”

In other words, the EITC expansions did more to boost employment among single mothers than the 1990s overhaul of the welfare system, as the chart shows. Recent proposals to build on the purported success of the 1996 welfare law by block-granting SNAP (food stamps) and other programs ignore this fact.

The EITC’s proven success as a work incentive explains why expanding it should be central to any initiative to raise employment among low-income individuals.

At the moment, of course, jobs are still scarce, so job inducements like the EITC aren’t likely to be as effective at putting people to work as they would be in a stronger labor market. Still, as the economy improves, the EITC and policies like it are promising.

A good place to start would be to strengthen the very small EITC for workers not raising children. This would be especially beneficial for less-educated single men, who have fared poorly in the labor market for many years — including prior to the recession, when employment among single mothers rose substantially (in no small part due to the EITC).