off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

Although the Senate Budget Committee will hold a hearing tomorrow titled “The Coming Crisis: Social Security Disability Trust Fund Insolvency,” Disability Insurance (DI) is not, in fact, in crisis. Here, briefly, are the facts (see our chart book and blog posts for more):

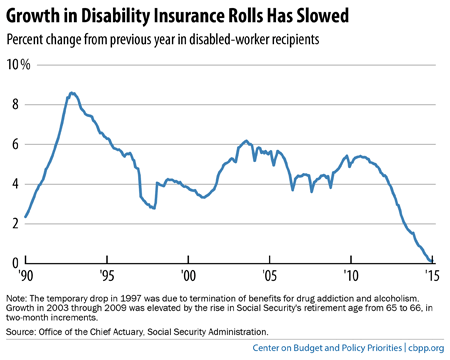

- DI’s recent growth stems mostly from well-understood demographic factors. The aging of the baby boomers into their 50s and 60s (peak ages for DI receipt), the rise in women’s labor force participation (which means more women now qualify for benefits), and the rise in Social Security’s full retirement age (which delays DI beneficiaries’ reclassification as retired workers) all contributed to the growth in the DI rolls. Those pressures are easing, and the DI rolls have barely grown for the last two years (see chart).

Image

- The need to replenish DI was long anticipated and has a simple solution. Rebalancing payroll taxes between DI and Social Security’s separate Old-Age and Survivors Insurance (OASI) fund, in either direction, is a traditional and historically noncontroversial way to even out the programs’ finances. Due to the last two such measures, DI now needs more funds soon while the OASI fund doesn’t. The DI trust fund is expected to run out in 2016 — the same year lawmakers expected back in 1994, when they approved the last rebalancing. Reallocating a small share of the payroll tax from OASI to DI would avert a 20-percent cut in DI benefits in 2016 and make both the OASI and DI trust funds solvent until 2033.

- DI’s eligibility standards are strict. Applicants must provide convincing medical evidence from qualified sources, and most applications are denied. (Those rejected applicants struggle in the labor market, evidence that DI’s standards are indeed stringent.) The Social Security Administration regularly reviews beneficiaries to weed out those who have recovered.

- Most DI beneficiaries are older. A typical beneficiary is in his or her late 50s or early 60s, with a high-school education or less and a history of physically demanding jobs. About 13 percent are veterans. DI recipients have high mortality rates: they’re at least three times as likely to die as other people their age.

- DI benefits are extremely modest. The average disabled worker receives $1,165 a month and virtually all (99.4 percent) get less than $2,500. Those benefits make a big difference, since DI beneficiaries — especially those who aren’t married — are far likelier to be poor or near-poor than other people.

- The United States spends less on disability benefits than most other advanced countries. The United States ranks 26th among the 34 members of the Organisation for Economic Co-operation and Development in spending on disability benefits as a share of the economy. The Netherlands, which DI critics often propose as a model, spends twice as much as the United States.

Even with its strict standards and modest benefits, this vital part of Social Security offers important protection to all working Americans.

Topics:

Blog

Disability Allowance Rates Fall as Social Security Strengthens Oversight of Hearings

February 10, 2015

Stay up to date

Receive the latest news and reports from the Center