BEYOND THE NUMBERS

Lawmakers considering federal tax reform proposals should take this opportunity to rebalance housing subsidies to better align spending with need, as I recently explained on the National Housing Institute’s Shelterforce blog.

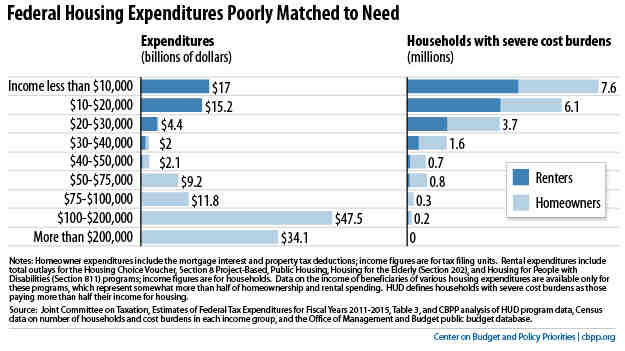

The federal government spent $270 billion in 2012 on tax breaks and direct spending to help families buy or rent housing. But most of that spending was on homeownership subsidies — like the mortgage interest deduction — that mainly benefit higher-income families, who would rarely struggle to afford homes without help (see chart). Meanwhile, the number of low-income families — especially renters — paying very high shares of their income for housing has grown rapidly.

As I explain in the post, Congress should take two steps as part of tax reform to rebalance the nation’s housing policy:

- Replace the mortgage interest deduction with a less-expensive, better-targeted credit. This would trim subsidies for higher-income families while expanding them for middle- and lower-income homeowners, many of whom receive little or no help from the existing deduction.

- Create a renters’ tax credit. As our updated paper explains, Congress could use some of the savings from reforming homeownership or non-housing tax subsidies to fund a new renters’ credit that would address part of the unmet need for housing assistance among the lowest-income renters. A renters’ credit capped at $5 billion, for example, would help about 1.2 million vulnerable households, reducing their rent by an average of $400 a month.

Click here to read the full post.