BEYOND THE NUMBERS

Great blog posts by our colleague Jared Bernstein and by Syracuse University professor Len Burman explain why the preferential tax treatment for capital gains — the gains from selling stocks, bonds, and other assets, which face a top tax rate of 15 percent, well below the top rates for ordinary income — is unjustified.

In two posts, Bernstein demonstrates that there is no convincing evidence that the preferential capital gains rate encourages investment or productivity growth. First, he shows that there is no clear correlation between the capital gains rate and the amount of real business investment. Then, he shows that the size of the difference between the capital gains rate and top ordinary income tax rate does not correlate with either real investment or investment growth.

Len Burman explains that the preferential capital gains rate fails miserably on other grounds as well, such as equity and efficiency:

- Citing Tax Policy Center data, Burman explains that fully 97 percent of reported gains in 2010 went to millionaires.

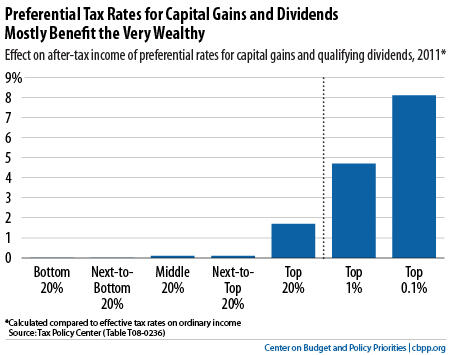

That’s one reason why, as we show in this chart, tax rates for capital gains and dividends are highly regressive, lifting after-tax incomes by a tiny fraction of a percent for the vast majority of households but by about 8 percent for the top 0.1 percent of households.

And, as we’ve explained, the preference is a reason why the current tax code violates the so-called “Buffett Rule” – that people making more than $1 million a year shouldn’t pay taxes at a lower rate than middle-income families. High-income taxpayers who receive a large share of their income from capital gains and dividends taxed at the preferential rates benefit much more from those rates than other taxpayers do. Consequently, a significant group of them pay a lower share of their incomes in federal income and payroll tax than do many middle-income Americans.

- Burman also notes that “taxing capital gains at much lower rates than other income creates a ginormous loophole that leads to a tremendous amount of inefficient tax shelter activity,” as filers seek to reclassify other income as capital gains.

At a time when we need to raise revenues responsibly to help address long-term deficits, the preferential tax treatment of capital gains — which costs the Treasury billions of dollars each year — makes no sense.