off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

Tax Cuts and Wars Will Continue to Fuel Debt Through the Decade

Receive the latest news and reports from the Center

As we noted yesterday, we’ve updated CBPP’s periodic analysis of the main contributors to the large budget deficits projected for the rest of this decade. That analysis also examines contributors to the public debt — which is basically the sum of annual budget deficits, minus surpluses, over the nation’s entire history.

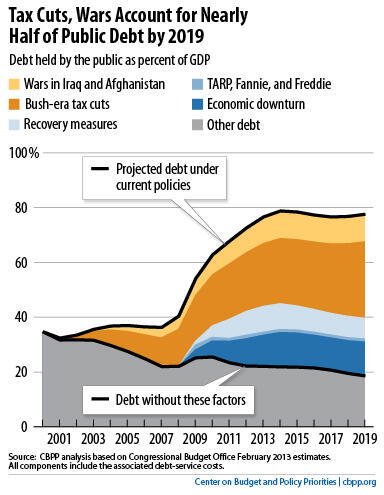

The goal of stabilizing the debt would be much easier to achieve if it weren’t for policies set in motion during the Bush years. That era’s tax cuts — most of which President Obama and Congress extended recently in the American Taxpayer Relief Act — and the wars in Iraq and Afghanistan will account for almost half of the debt that we’ll owe, under current policies, by 2019 (see chart). By contrast, the economic recovery measures and financial rescues of recent years will account for just over 10 percent of the debt at that time.

The Great Recession hammered the budget — driving down tax revenues and swelling outlays for unemployment insurance, SNAP (food stamps), and other safety net programs — and thereby added to rising debt. But without the tax cuts and the wars, we would have entered the downturn with much less debt. This would have allowed us to absorb the recession’s damage to the budget and the cost of economic recovery measures, while keeping debt comfortably below 50 percent of Gross Domestic Product (GDP). As such, the nation would have been on a much sounder footing to address the demographic challenges and the cost pressures in health care that darken the long-run fiscal outlook.