BEYOND THE NUMBERS

As we’ve shown in our blog series over the past week, millions more Americans would face poverty and severe hardship without programs like TANF, housing assistance, SNAP (food stamps), and unemployment insurance — as well as other programs that this series didn’t focus on, such as Social Security and the Earned Income Tax Credit.

Still, the tax code and government transfer programs do less than they could or should to reduce poverty.

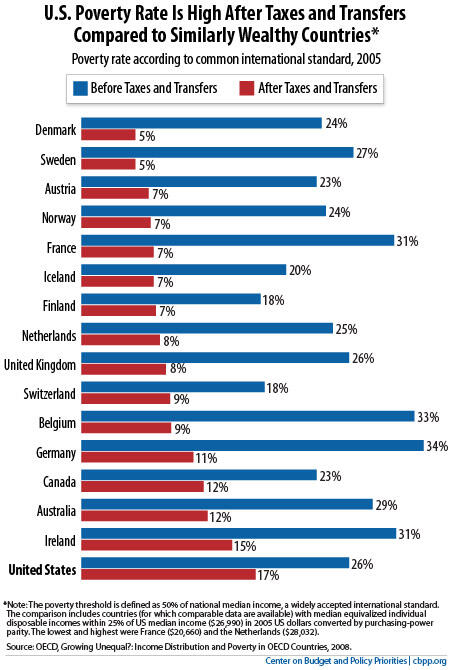

Other similarly wealthy countries have far lower rates of poverty after factoring in the impact of safety net programs even though, on average, they have similar rates of poverty before counting these programs (see chart). That’s true largely because nearly all of these other countries do more: their programs are more generous, easier to access, and broader in scope than those in the U.S.

Let’s remember: people need these programs because they either receive inadequate wages or cannot work. For many working Americans, a job alone is inadequate to lift a family out of poverty. Economic Policy Institute data show that in 2007 (the most recent year available), over 25 percent of all workers received wages that were inadequate to keep a family of four out of poverty.

These programs also help support many people who cannot work, including children, the elderly, and people with significant disabilities, as well as able-bodied adults who cannot secure adequate employment because jobs are scarce.

The safety net also helps push back against growing inequality, though not as effectively as it once did.

And research shows that keeping young children out of poverty helps them succeed in school and earn more as adults.

As policymakers consider proposals to address medium- and long-term deficits, they should keep these facts in mind and avoid cuts that would worsen the nation’s already high rates of poverty and inequality. To further reduce poverty and inequality, we’ll eventually need to spend more in a fiscally responsible way. We’ll also need to make our tax system more progressive — and do so in a way that raises more revenues to meet the nation’s pressing needs and promotes more broadly shared prosperity.