BEYOND THE NUMBERS

With the budget challenges of the Great Recession and its aftermath still fresh in their minds, state policymakers are considering ways to strengthen their “rainy day funds” — budget reserves they can use when recessions or other unexpected events cause revenues to fall or spending to rise. But, it’s still premature for most states to act aggressively to refill the funds until their revenues rise well above pre-recession levels, unemployment has declined further, and they have restored programs cut during the recession, as we explain in a new paper.

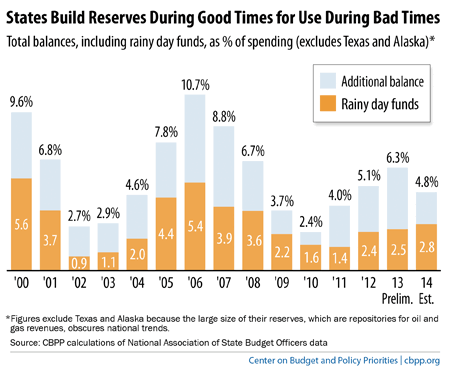

States used their rainy day funds to avert over $20 billion in cuts to services, tax increases, or both, in each of the last two recessions, highlighting the funds’ importance. Since draining reserves to a low of 2.4 percent of spending in state fiscal year 2010, states have begun to refill them partly (see chart).

The decisions about when and how quickly to refill a rainy day fund will be different for each state. Here are some questions that states should consider:

- Have tax collections recovered from the recession? One sign that a state has sufficient funds to begin refilling its rainy day fund is that both its annual tax collections and its annual growth in tax collections have returned to pre-recession levels, after accounting for inflation. Fewer than half of the states have recovered to this extent.

- Has the state’s economy recovered? A return to pre-recession unemployment rates and personal income indicates that the state’s economy is on the mend. Then the state can more likely meet the needs of its residents and also set funds aside for future downturns. Most state economies have not yet fully recovered from the downturn.

- How big is the rainy day fund? Resuming fund deposits is a higher priority in states with little or no funds remaining. These states may want to spread the replenishment over more years and should consider beginning sooner. At the end of fiscal year 2013, 16 states had general fund reserves of less than 5 percent of the budget.

- What else might states do with available funds? A rainy day fund’s ultimate goal is to help maintain state support for education, health care, transportation, and other services that promote economic growth and meet residents’ needs. If depositing money in the fund would jeopardize a state’s ability to support these programs adequately — especially after years of funding cuts in an economic downturn — program funding should take priority.

- Is the state experiencing a revenue “windfall”? Some states’ revenue collections are temporarily high as a result of a court settlement or other short-term reason. For example, Connecticut received $175 million this year from a temporary tax amnesty program, and Louisiana is receiving payments from BP as a result of the 2010 oil spill. States should use caution when deciding how to spend these temporary windfalls. Shoring up a rainy day fund is a prudent use of one-time funds, while enacting ongoing program expansions or permanent tax cuts could contribute to future budget imbalances.

Click here to read the full paper.