BEYOND THE NUMBERS

The House Agriculture Committee will soon take up a bill to reauthorize federal farm programs, and it’s expected to include even deeper and more damaging cuts to the Supplemental Nutrition Assistance Program (SNAP, formerly known as Food Stamps) than its version from last year. And, those cuts would deepen the benefit cuts that SNAP participants already face this year.

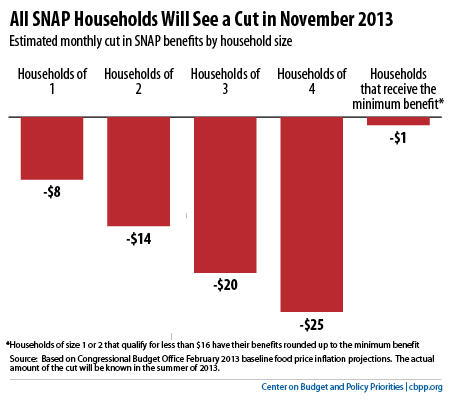

SNAP benefits will fall for every SNAP household on November 1, when the 2009 Recovery Act’s temporary benefit boost ends. For a family of three, the cut likely will be $20 to $25 a month — or $240 to $300 over 12 months, according to Congressional Budget Office estimates (see chart). Our revised paper details the cuts, including the estimated effect in each state.

That’s a serious loss, especially in light of the already very low basic SNAP benefits. Without the Recovery Act’s boost, SNAP benefits average only about $1.30 $1.40 (in fiscal year 2014 dollars) per person per meal. Nutrition experts have long held that these levels are inadequate to meet families’ basic food needs.

These cuts will likely cause hardship for some SNAP participants, who include 22 million children (10 million of whom live in “deep poverty,” with family incomes below half of the poverty line) and over 9 million people who are elderly or have a serious disability.

Moreover, they’ll reduce funds for a program that has proven its effectiveness.

- SNAP provides a basic nutrition benefit to many low-income Americans. The program has largely eliminated severe hunger and malnutrition in the United States.

- SNAP is highly responsive to need. As an entitlement, it responds quickly and effectively to support low-income families and communities during times of economic distress.

- SNAP is a powerful anti-poverty program. SNAP lifted about 4.7 million Americans above the poverty line in 2011, including about 2.1 million children. Roughly 91 percent of SNAP benefits go to households with incomes below the poverty line.

- SNAP is an important work support. The number of low-income working households on SNAP has risen dramatically over the past decade, reflecting both a substantial rise in SNAP participation among eligible low-income working households as well as wage erosion at the low end of the wage scale.

- SNAP benefits are among the most effective forms of economic stimulus. In a weak economy, every $1 increase in SNAP benefits generates $1.70 in economic activity, according to Moody’s Analytics.

- SNAP has one of the most rigorous payment error measurement systems of any public benefit program. Its payment error rates are at an all-time low. In 2010, only 3 percent of all SNAP benefits represented overpayments.

The November benefit cut already will make it tougher for millions of families to put food on the table. Congress should reject proposals that would increase this burden on our most vulnerable people.

Click here to read our full paper on the Recovery Act cuts, including estimates of the state-by-state impact.