BEYOND THE NUMBERS

Facts on SNAP, Part 4: SNAP Responded to the Recession and Will Shrink as the Economy Improves

As the Senate and House Agriculture Committees consider changes to SNAP (formerly food stamps) this week, we’ve laid out some basic facts about the program: the people it serves, the ways that it encourages work, and its strong record of efficiency. This last post in our series explains that SNAP’s recent growth is temporary and shows that the program is working as designed.

- SNAP responded quickly and effectively to the recession. SNAP spending rose considerably when the recession hit. That’s precisely what SNAP was designed to do: quickly help more low-income families during economic downturns as poverty rises, unemployment mounts, and more people need assistance.

As the Congressional Budget Office (CBO) has stated, “the primary reason for the increase in the number of participants was the deep recession from December 2007 to June 2009 and the subsequent slow recovery.”

- A temporary benefit increase accounted for some of that growth. President Obama and Congress boosted SNAP benefits as part of the 2009 Recovery Act in order to reduce hardship and deliver high “bang-for-the-buck” economic stimulus. This provision accounted for 20 percent of the growth in program cost between 2007 and 2011, according to CBO. The temporary benefit increase is phasing out and will end on October 31.

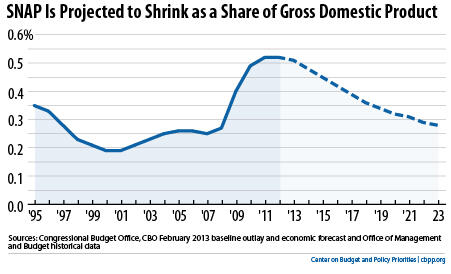

- SNAP spending growth has slowed in the past year and is expected to reverse in the coming year or two (see graph). As the economy has recovered, SNAP caseload and spending growth have slowed substantially. SNAP spending in the first quarter of calendar year 2013 was only 0.3 percent higher than the same period in 2012. In coming years, caseloads and spending are expected to begin declining as households’ economic circumstances improve and the Recovery Act’s benefit increase ends.

- Policy changes — notably, expanded categorical eligibility — have not been a major factor in recent SNAP spending growth. Categorical eligibility allows states to provide food assistance to households that struggle to meet their food needs — mostly working families and seniors — with gross incomes or assets just above federal SNAP limits. But this option accounts for only about 2 percent of program costs, according to CBO. The other factors cited above dwarf the effects of the categorical eligibility state option.

- Because SNAP is projected to shrink as a share of the economy, it is not contributing to the nation’s long-term budget problems. Unlike health care programs and Social Security, there are no significant demographic or programmatic pressures that will cause SNAP costs to grow faster than the economy.

SNAP serves vulnerable populations, encourages work, is efficient and effective, and is working as it was designed to — all good reasons to protect this critical program from damaging cuts.

For more information about SNAP, see our Chart Book.