BEYOND THE NUMBERS

Millions of people would lose part or all of their SNAP (formerly food stamps) benefits under the new budget from House Budget Committee Chairman Paul Ryan, our new report shows.

The Ryan budget cuts SNAP by $137 billion over ten years (2015-2024). It includes every major benefit cut in the House-passed version of the farm bill from last year that Congress ultimately rejected. On top of these cuts, which total $12 billion over 2015-2018 and would end food assistance for 3.8 million people, it converts SNAP into a block grant beginning in 2019 and cuts it by another $125 billion — almost 30 percent — over 2019-2024.

Since 90 percent of SNAP spending goes to food assistance, a cut of that size would require restricting SNAP eligibility for needy people, slashing benefits, or both.

- If the cuts came solely from restricting eligibility, states would have to cut an average of 10 million people from the program (compared to SNAP enrollment without the cuts) each year between 2019 and 2024.

- If the cuts came solely from across-the-board benefit cuts, states would have to cut SNAP benefits by more than $40 per person per month over 2019-2024 (in nominal dollars), or almost 30 percent, on average.

Chairman Ryan justifies his deep SNAP cuts in part by claiming that the “explosive growth [of SNAP and other low-income programs] is threatening the overall strength of the safety net.” While SNAP spending grew substantially during the recession, it has begun to decline as a share of the economy and is expected to continue shrinking over the coming decade as the economy continues to recover and fewer people need SNAP.

Chairman Ryan also implies that SNAP doesn’t encourage recipients to work. Yet the large majority of SNAP recipients who can work do work: among SNAP households with at least one working-age, non-disabled adult, more than half work while receiving SNAP and more than 80 percent work in the year prior to or the year after receiving SNAP. The rates are even higher for families with children: more than 60 percent work while receiving SNAP, and almost 90 percent work in the prior or subsequent year.

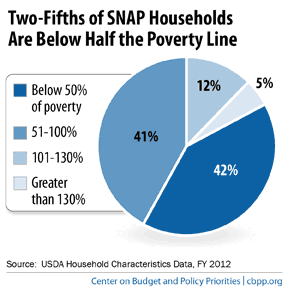

It’s important to remember that SNAP serves very vulnerable people. Eighty-three percent of SNAP households have incomes below the poverty line (about $19,800 for a family of three); 42 percent have incomes below half the poverty line (see chart). Also, millions of low-wage workers rely on SNAP to feed their families.

SNAP cuts of the size that Chairman Ryan proposes would almost certainly mean more hunger and more poverty.