off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

Remaining States Should Opt Out of Costly Corporate Tax Break

Receive the latest news and reports from the Center

I listed four reasons recently why states shouldn’t cut their corporate income taxes. In a new paper, I describe a tax change that they should make: cancel a corporate tax break that costs them hundreds of millions of dollars each year.

The federal government created the tax break, known as the “domestic production deduction,” in 2004. Since most states’ tax codes are tied to the federal tax code, the deduction took effect automatically in most states as well, without policymakers’ explicit approval — or even their knowledge in many cases.

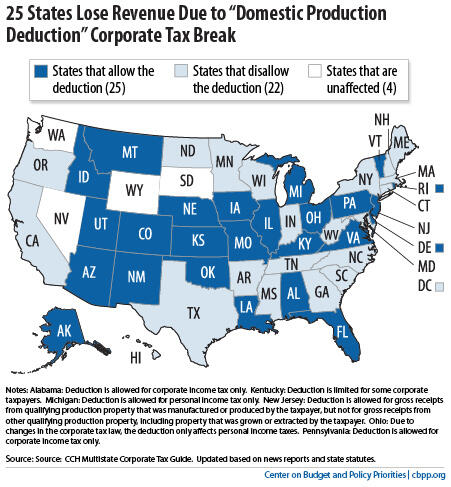

Twenty-two of the 46 states with a corporate income tax (including the District of Columbia) have since “decoupled” their tax codes from the deduction, but 25 haven’t (see map). The revenue loss to states that still allow the deduction has grown steeply over the past few years. By 2014, the deduction will cost them over $600 million per year.

There is no good reason to accept such revenue losses. The deduction:

To decouple from the deduction, a state need only add a single sentence to its tax law. That’s a simple change — and a smart one.