off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

Image

- The 51 percent figure is an anomaly that reflects the unique circumstances of 2009, when the recession swelled the number of Americans with low incomes and when temporary tax cuts created by the 2009 Recovery Act were in effect. Together, these developments removed millions of Americans from the federal income tax rolls. In a more typical year, 35-40 percent of households owe no federal income tax.

- The 51 percent figure ignores the substantial amounts of other federal taxes — especially the payroll tax — that many of these households pay. Only about 14 percent of households paid neither federal income tax nor payroll tax in 2009, despite the high unemployment and temporary tax cuts, according to the Urban Institute-Brookings Tax Policy Center. This percentage would be even lower if federal excise taxes on gasoline and other items were taken into account.

- Low-income households also pay substantial state and local taxes. The poorest fifth of households paid 12.3 percent of their incomes in state and local taxes in 2010, according to data from the Institute on Taxation and Economic Policy.When all federal, state, and local taxes are taken into account, the bottom fifth of households paid 16.3 percent of their incomes in taxes, on average, in 2010. The second-poorest fifth paid 20.7 percent.

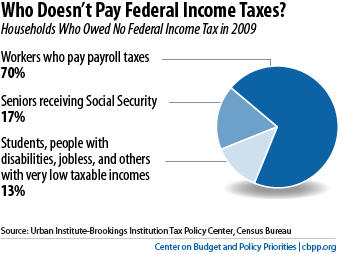

- Claims that people who don’t owe federal income tax are “freeloaders” who don’t have a “stake in the system” are incorrect. Roughly 70 percent of people who owe no federal income tax in a given year are low-income working households. As noted above, these people pay payroll taxes, as well as federal excise taxes and state and local taxes. Most of these households also pay federal income tax in other years, when their incomes are higher. For example, recipients of the Earned Income Tax Credit pay much more in federal income taxes over time than they receive in EITC benefits — $473 billion more over an 18-year period covered by a leading study.The remaining 30 percent of people who owe no federal income tax in a given year consists of seniors, students, people with disabilities, the long-term unemployed, and others with very low taxable incomes (see chart).

- The policy changes needed to make many more low-income people pay federal income tax would make the tax system less fair and less sensible, not more so. Policymakers would have to take such steps as lowering the personal exemption or standard deduction, which would tax many low-income working families into (or deeper into) poverty; weakening the EITC or Child Tax Credit, which would significantly increase child poverty while reducing incentives for work over welfare; or paring back the tax exclusion for Social Security benefits, which would subject more seniors with small, fixed incomes to the income tax.

As our report states, the federal tax system is progressive overall, but state and local tax systems are regressive and undo a significant share of that progressivity. There is nothing wrong with having one part of the overall tax system shield low- and moderate-income households, who pay substantial amounts of other taxes and who generally pay federal income tax as well in other years.

Stay up to date

Receive the latest news and reports from the Center