BEYOND THE NUMBERS

Paying for Tax “Extenders” Would Help Restrain Debt

“Lawmakers from both sides of the aisle are starting to ramp up their efforts to renew targeted tax breaks set to expire at the end of the year,” The Hill notes. Our new report explains that, simply by paying for any renewal of these and other tax “extenders,” policymakers could shrink by one-third the projected increase in the debt as a share of the economy over the next several decades. Here’s the opening:

Several dozen temporary tax-expenditure provisions, collectively known as “tax extenders” because Congress routinely extends them, are set to expire again at year’s end. More such provisions expire at the end of 2014. Given the importance of addressing mid-term and long-term deficits, policymakers should make a firm commitment to pay for any extension of these provisions.

Policymakers are negotiating a package to ease the sequestration budget cuts over the next couple of years and to pay for the cost of doing so. In coming weeks, policymakers also will seek to extend relief from the scheduled deep cuts in Medicare payments to physicians, and — as they have done in each of the past few years — they will offset that cost as well. The tax extenders should be no different.

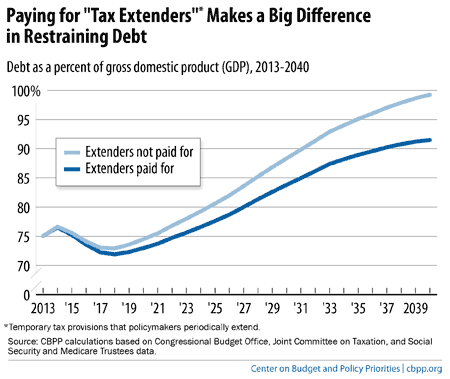

Paying for those “extenders” that Congress continues would have a significant impact on long-term deficits. The publicly held debt amounted to 75 percent of GDP (gross domestic product) in 2013, and we project that it will climb under current policies to 99 percent of GDP in 2040. (This estimate assumes the extenders are continued but not paid for.) If policymakers offset the roughly $50 billion-a-year cost of continuing the extenders, the debt-to-GDP ratio will rise about 8 percentage points less, reaching 91 percent in 2040. An eight-percentage-point improvement would eliminate about one-third of the projected rise in the debt ratio by 2040 under current policies, far from sufficient to address long-term deficits and moderate the debt ratio but an important step toward accomplishing that.

Click here for the full report.