BEYOND THE NUMBERS

Our New Look at the Long-Term Budget Picture

The long-term budget outlook remains challenging, but recent legislation and other developments have made it more manageable, our major new report finds. Here’s the opening:

Despite marked improvement since our previous projections of 2010, the long-run budget outlook remains challenging and will ultimately present policymakers with difficult choices, according to CBPP’s updated projections through 2040.

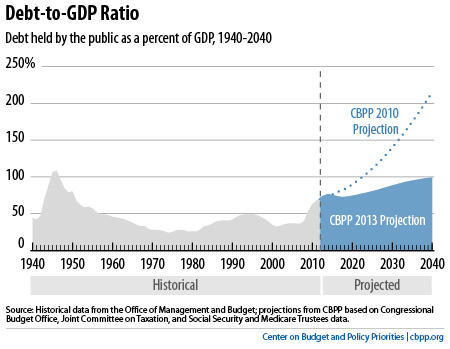

Under current budget policies, the federal debt will edge down as a share of the economy in the middle of this decade but then resume a gradual rise. The projected ratio of debt to gross domestic product (GDP) — which was 73 percent at the end of fiscal year 2012 — will reach 78 percent in 2023 and 99 percent by 2040. (See graph.)

Although the rising debt-to-GDP ratio remains a concern, we no longer project the debt to grow at an explosive rate, as many previous estimates (including ours) indicated and as many analysts and policymakers have taken as conventional wisdom about the long-term outlook. Since we issued our previous long-term projections in early 2010, the projected debt-to-GDP ratio in 2040 has shrunk by half — from 218 percent of GDP to 99 percent. The long-term “realistic baseline” of the Committee for a Responsible Federal Budget (CRFB), a nonpartisan fiscal watchdog, paints a similar picture, with a projected debt-to-GDP ratio of 108 percent in 2040. (CRFB issued its projection before the Medicare and Social Security trustees released their 2013 reports, which slightly improve the outlook.) The Center for American Progress’s recent long-term forecast is also similar.

Our updated long-term projections are the product of several months of analysis and incorporate the recent Social Security and Medicare trustees’ reports and the new budget baseline that the Congressional Budget Office (CBO) issued in May. Our new projections come at a time of renewed attention to fiscal policy challenges, with White House officials and some senators beginning to meet to seek paths forward on sequestration, the debt limit, and possibly broader budget issues.

Recent legislation and other factors have substantially improved the long-term budget outlook. Health reform (the 2010 Affordable Care Act, or ACA) and other developments have significantly slowed the projected growth of Medicare spending. The 2011 Budget Control Act (BCA) has sharply cut projected discretionary spending. And the American Taxpayer Relief Act (ATRA), enacted in January, and the ACA have increased tax revenues. Along with these policy changes, interest rates have remained unusually low and health care spending growth has slowed for reasons that go beyond the ACA’s direct effects.

Three major policy uncertainties affect the fiscal outlook for the years immediately ahead: (1) whether sequestration will remain in effect after fiscal year 2013 and, if not, whether policymakers will replace it with measures that yield equivalent savings; (2) whether policymakers continue to block scheduled deep cuts in Medicare physician payments and, if so, whether they offset those costs; and (3) whether policymakers extend a group of largely corporate tax expenditures (the “tax extenders”) that are scheduled to expire every year or two and, if so, whether they offset those costs.

For this long-term analysis, we have elected to pursue the most cautious course by assuming that policymakers will cancel sequestration and the scheduled Medicare physician cuts and extend the expiring tax provisions, all without offsetting the costs. (Here, we depart slightly from the standard ten-year baseline that we, CRFB, and some other groups use for budget analyses.) Had we made different assumptions on these policy issues, our projected debt-to-GDP ratio in 2040 would be lower than 99 percent. For example, if we assumed that the tax extenders either will be allowed to expire or will be offset — as do the baselines that CRFB and we have traditionally used — the debt ratio in 2040 would be 91 percent.

Click

for the executive summary and here for the full report.