BEYOND THE NUMBERS

Demographic and economic factors explain much of the increase in the number of people receiving Social Security disability benefits in recent decades. But that’s not the impression you’d get from some alarmist recent reports. Senator Tom Coburn (R-OK), a member of the President’s fiscal commission, told the commission that disability payments were “out of control,” and authors of a new Brookings Institution report described the program as a “rapidly growing expense” that has “largely escaped the scrutiny of policymakers.”

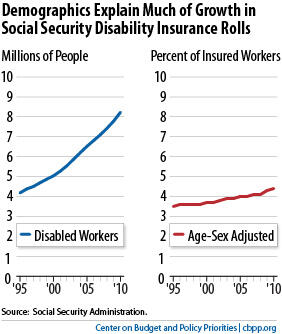

Here are the facts. This month, 8.2 million people will receive disabled-worker benefits from Social Security. (Payments will also go to some of their family members: 160,000 spouses and 1.8 million children.) The number of disabled workers has doubled since 1995, while the working-age population — conventionally described as people age 20 through 64 — has increased by only about one-fifth. But that comparison is deceptive. Over that period:

- Baby boomers aged into their high-disability years. People are roughly twice as likely to be disabled at age 50 as at age 40, and twice as likely to be disabled at age 60 as at age 50. As the baby boomers (people born in 1946 through 1964) have grown inexorably older, disability cases have risen.

- More women qualified for disability benefits. In general, workers with severe impairments can get disability benefits only if they’ve worked for at least one-fourth of their adult life and for five of the last ten years. Until the great influx of women into the workforce that occurred in the 1970s and 1980s, relatively few women met those tests; as recently as 1990, male disabled workers outnumbered women by nearly a 2 to 1 ratio. Now that more women have worked long enough to qualify for disability benefits, the ratio has fallen to just 1.1 to 1.

- Social Security’s full retirement age rose from 65 to 66. When disabled workers reach the full retirement age, they begin receiving Social Security retirement benefits rather than disability benefits. The increase in the retirement age from 65 to 66 has delayed that conversion for many workers. This month, over 300,000 people between 65 and 66 are collecting disability benefits; under the rules in place a decade ago, they would be receiving retirement benefits instead.

Not surprisingly, the rate crept upward during periods of economic distress. Anecdotally and statistically, we know that many workers who can’t find jobs and who exhaust their unemployment benefits turn to disability insurance.

Disability is a personal tragedy and economic hardship for workers and their families. We should strive to aid these workers through job accommodations (such as special equipment to help them perform their job), universal health insurance, and rehabilitation opportunities — while also recognizing that Social Security disability insurance is a crucial part of our nation’s safety net.