BEYOND THE NUMBERS

President Obama’s new, robust, and ambitious jobs plan is a well-crafted measure that would provide significantly more job and earnings opportunities for working Americans. Given the economic difficulties facing America’s families, Congress should enact it sooner rather than later.

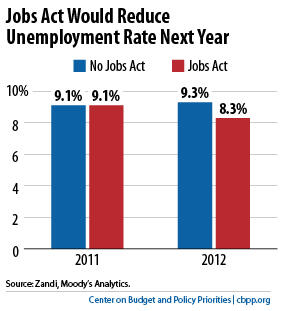

In fact, as the chart reveals, if Congress fails to pass any of the measures in the American Jobs Act, we should expect the unemployment rate to be slightly higher next year (9.3 percent). But with the AJA job-creation measures at work in the economy, the jobless rate would be 8.3 percent. That’s still too high, but it’s a marked improvement.

As expected, the President called for renewing the payroll tax cut and extending unemployment insurance benefits, both of which are scheduled to expire at the end of this year. But he also called for considerable extensions of both policies.

On the payroll tax break, he proposed raising the 2 percentage-point cut to 3.1 percentage points (half of the overall payroll tax on employees). The benefits of the tax cut to a typical worker earning $50,000 per year would grow from $1,000 to $1,550.

Employers also pay a 6.2 percent payroll tax, and the President proposed cutting that in half to 3.1 percent, capped at $5 million of payroll. In other words, employers would benefit from tax relief of up to $155,000. Since large businesses have payrolls well over the $5 million cap, the structure of this tax cut favors small businesses.

Just as under the current payroll tax cut, the federal government would transfer general revenues to Social Security to reimburse it for the revenues lost through the payroll tax cut.

The President’s proposed extension of unemployment benefits includes a new $4,000 credit to employers who hire the long-term unemployed (those seeking work for at least six months).

On the infrastructure side, the President’s plan includes $50 billion for surface transportation projects, $30 billion for public school and community college repairs and renovations, and a $10 billion down payment for an infrastructure bank.

Also, given the serious loss of state and local jobs during the downturn, the plan wisely includes $35 billion to preserve jobs of teachers and “first responders” such as police and firefighters. Other parts of the jobs plan include:

- a $15 billion neighborhood stabilization fund to help improve and repair low-income housing, including homes vacant due to foreclosure, that can then be sold to low-income homebuyers;

- a $5 billion “Pathway Back to Work Fund,” including summer jobs for low-income adults and youth, subsidized jobs for members of low-income families, and a training/work placement program.

- an on-the-job training program for unemployment recipients; and

- a small business expensing program that allows businesses to write off the cost of certain capital expenses (typically equipment and software) in one year as opposed to the usual many years.

The President proposed paying for the package through revenue increases and spending cuts. But to avoid canceling out the stimulative impact of the plan, these “pay-fors” would kick in down the road, when the economy is presumably stronger.