off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

Next Round of Deficit Reduction Shouldn’t Ignore Tax Entitlements

Receive the latest news and reports from the Center

Republican leaders’ insistence that future deficit reduction come entirely from spending cuts would entail cutting entitlement programs that mainly help poor and middle-class families while shielding tax breaks that mostly help the wealthy, our new report explains. Here’s the opening:

Since President Obama and Congress enacted the “fiscal cliff” budget deal, congressional Republican leaders have vowed not to raise a dollar more in taxes for deficit reduction. All further deficit reduction, they say, must come from budget cuts, primarily from entitlement programs. That, however, would spare the broad category of tax deductions, exclusions, credits, and other tax preferences known collectively as “tax expenditures” — which disproportionately benefit well-to-do Americans and which Alan Greenspan has termed as “tax entitlements” — while putting the onus entirely on spending programs, which disproportionately benefit middle- and lower-income Americans.

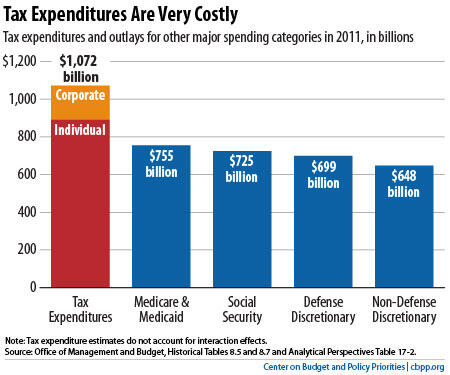

Tax expenditures are costly (see chart), and many of them are wasteful. Because tax expenditures disproportionately benefit those at the top while spending programs primarily benefit those in the middle or at the bottom, a strategy that protects the former entitlements while cutting the latter would be highly regressive.