off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

New Findings Show Unemployment Insurance Trumps High-Income Tax Cuts on Jobs, Deficits

Receive the latest news and reports from the Center

CORRECTED December 10th, 2010: The Figures for 2012 payroll employment and unemployment rate in table 2 have been corrected. In the previous version the figures shown were for 2013 instead of 2012.

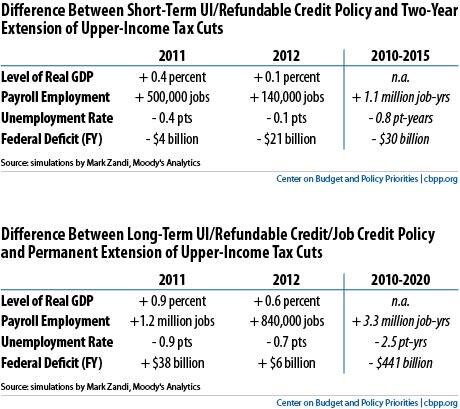

We’ve received some eye-popping

from Mark Zandi, chief economist at Moody’s Analytics, that flesh out an important point that the Congressional Budget Office, Zandi, and many others have made before: unemployment insurance (UI) and tax cuts focused on low- and moderate-income households have a much larger economic impact than income tax cuts for high-income individuals. I’ll be writing a more detailed report later, but here they are in a nutshell:

Friday’s jobs report reminds us that the economy still needs a job-creating boost. As Federal Reserve Chairman Ben Bernanke said in a recent speech, “a fiscal program that combines near-term measures to enhance growth with strong, confidence-inducing steps to reduce longer-term structural deficits would be an important complement to the policies of the Federal Reserve.” These results show that, compared with a policy of extending the high-income tax cuts, a policy emphasizing unemployment insurance and refundable tax credits is far better for enhancing growth in the near term without undermining deficit reduction efforts in the longer term.