BEYOND THE NUMBERS

A recent New York Times editorial about corporate tax avoidance panned two proposals — a “territorial” tax system and a tax repatriation holiday — that some U.S.-based multinational companies are backing. We heartily agree with the Times’ assessment that these proposals could worsen an already flawed corporate tax structure.

A territorial tax system — under which a country generally taxes only the income that a corporation generates in that country, leaving other countries to tax the income generated elsewhere — would create greater tax incentives for multinationals to invest and move profits overseas rather than in the United States, as we’ve explained. Even a “tough” territorial system with safeguards against inappropriate profit-shifting to low-tax countries would not fully prevent an exodus of investment and profits from the United States. As a result, such a system would risk hurting domestic workers and businesses, boosting deficits over the long run, and weakening the economy.

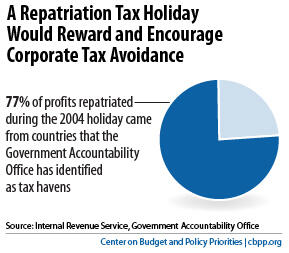

A second holiday would be worse. Congress’ tax scorekeeper, the Joint Committee on Taxation, estimates that it would increase the deficit by tens of billions of dollars over ten years. Worse, it would give multinationals an incentive to shift even more profits and investments overseas, in the hope that Congress would offer still another tax holiday at some point. That’s why, when it enacted the first holiday, Congress said that it should be a one-time only deal. It was a mistake that shouldn’t be repeated.