BEYOND THE NUMBERS

A new Wall Street Journal/NBC poll shows surprising support for “means-testing” Social Security — in other words, reducing or denying benefits to retirees with incomes above a certain level — to help close the program’s long-term funding gap. But a new analysis by the Center for Economic and Policy Research (CEPR) confirms that means-testing would yield very little in savings … unless we took benefits away not only from rich retirees, but also from many who are solidly middle-class.

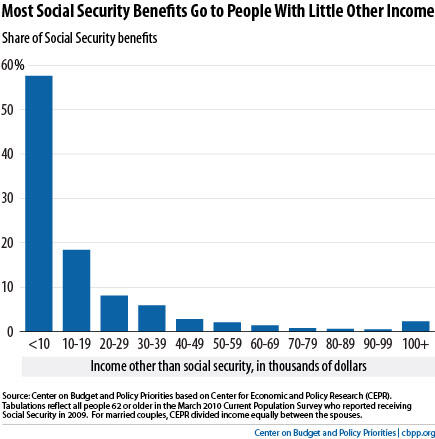

The reason, as the CEPR analysis shows, is that there aren’t enough rich retirees — and they don’t collect enough in Social Security — to make much of a difference. Only 2 percent of Social Security benefits go to retirees with other (non-Social Security) income of $100,000 or more each year. (See chart.) Only about 10 percent of benefits go to people with outside income of $40,000 or more a year — a figure that most of us would regard as middle class.

Social Security benefits are modest even for the highest-income retirees. The average retired-worker benefit is only $1,175 a month (about $14,100 a year). And because the program has always capped the amount of earnings — currently $106,800 — on which workers pay taxes and accrue benefits, even its top benefits aren’t lavish. Someone retiring at age 65 in 2010 could get, at most, $2,192 a month (about $26,300 a year); only 5 percent of retirees collected more than $2,000 a month. So although some rich people get Social Security, nobody gets rich from Social Security. That limits how much we could save by taking it away from them.

Means-testing would also penalize people who planned prudently for their senior years. Income security during retirement is often likened to a three-legged stool — consisting of Social Security benefits, employer pensions, and personal savings — sometimes supplemented by part-time employment. Reducing Social Security for people whose non-Social Security income is higher because they built up savings during their working years or take a part-time job would sap incentives to work and save. It would also create strong incentives for retirees to understate their income or reshuffle their assets to avoid the benefit reduction.

A further problem with means-testing, as CEPR and the American Academy of Actuaries point out, is that it would add a major administrative burden to Social Security, imposing costs that would eat into the benefit savings.

In short, taking Social Security benefits away from high-income retirees wouldn’t save much money and would unnecessarily alter the program’s philosophy and administration.