BEYOND THE NUMBERS

Megan McArdle has previously criticized our comparison of the size of the Social Security shortfall over the next 75 years and the cost of extending the Bush-era tax cuts for high-income taxpayers over that period. In two posts (here and here), we explained why her concerns were misguided.

I’ll make just two key points.

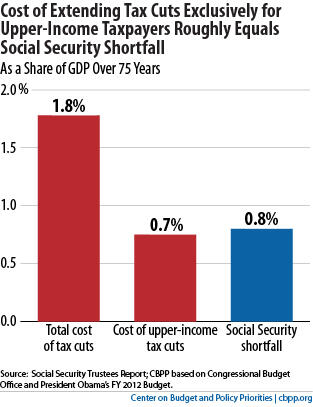

First, contrary to McArdle’s charge, we never claimed that policymakers can “pay for Social Security by ending the Bush tax cuts on high earners.” As I wrote last year, “We have made quite clear that President Obama and Congress should let the upper-income tax cuts expire and devote the proceeds to deficit reduction. At the same time, as Kathy and I wrote, we have consistently argued that Congress should enact revenue and benefit changes that would place Social Security on a sound long-term financial footing. In comparing the high-income tax cuts to the Social Security shortfall, we wanted to illustrate the hypocrisy of Members of Congress who argue that the tax cuts are affordable but Social Security is not, even though their cost is about the same.”

Paul Krugman made this same point last year in a more trenchant way: “The basic position here is that people on the right favor high-end tax cuts that will worsen the deficit, while at the same time demanding both immediate fiscal austerity and cuts to Social Security, in the name of deficit reduction. They justify their tax cuts/austerity position by arguing that what’s important is holding down current deficit numbers, never mind the 10-year outlook. Meanwhile, they declare that it’s urgent that we act now to lock in cuts in Social Security benefits that won’t take place for decades. Why, it’s almost as if they’re grabbing any argument at hand to justify spending cuts for the middle class and tax cuts for the rich, regardless of the inconsistency.”

Second, McArdle questions our use of present values to compare costs over a 75-year period. But present values are entirely appropriate for such a comparison. As Brad DeLong explained in response to McArdle’s earlier post: “When you want to compare two streams of cash flows to see which is more valuable — to sum up how much you should be willing to pay for it in one number — you compute present values. That is what they are there for. That is what they do. That is the only reason they were developed. That is the only reason that they exist.”