BEYOND THE NUMBERS

Our latest update on state budget shortfalls shows that states continue to face a long and uncertain recovery.

The report finds that:

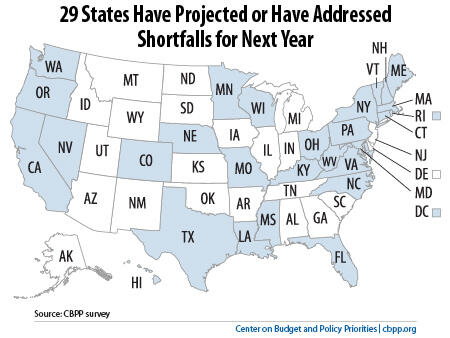

- States’ budget challenges remain considerable. Twenty-nine states have projected or have addressed budget gaps totaling $44 billion for fiscal year 2013, which begins July 1 in most states. (See map.) This number is almost certain to grow as governors release new gap projections along with their budgets in the coming months. States will have to close these gaps before the fiscal year begins, since nearly every state is required to balance its budget. (These 29 states include some states with two-year budget cycles ending in fiscal year 2013, most of which have already closed their projected 2013 shortfalls through spending cuts and other measures scheduled to take effect next year.)

- State finances are recovering, but slowly. Shortfalls are generally smaller than in previous years. But they remain large by historical standards, as the economy continues to be weak and unemployment is still high.

Revenues remain below the amount needed to sustain services like education and public safety, in part because states are coming out of such a deep hole. State revenues plunged as a result of the recession, and, while they are now growing again, it would take years of growth at the current rate to maintain services at anywhere near pre-recession levels, as my colleague Elizabeth McNichol has pointed out.

Moreover, states are facing serious headwinds that will slow their recovery. Emergency federal aid to states has largely expired, and large cuts in federal spending scheduled for coming years will likely affect ongoing federal funding for states and localities. Growth in the broader economy has been sluggish, as well.

Given these challenges, states should take a balanced approach as they prepare their budgets for the coming year — one that draws on reserves (in states that have them) and raises additional revenue, rather than relying on cuts alone.

The budget that California governor Jerry Brown proposed last week provides a good example: while it makes $4.2 billion in cuts to Temporary Assistance for Needy Families (TANF), Medicaid, and a host of other programs, it also raises $4.7 billion in additional revenue, primarily by creating new income tax rates for very high earners and raising the sales tax rate by half a percentage point. As Governor Brown recognized, a cuts-only approach would deepen the already severe cuts that states have made over the last several years to services that are critical to states’ economic futures, like K-12 education.