BEYOND THE NUMBERS

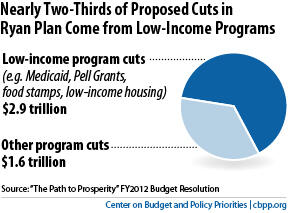

The House may soon consider two bills (H.R. 3576 and H.R. 3580) that would limit federal spending to levels similar to those in the budget of Budget Committee Chairman Paul Ryan (R-WI) that the House passed last April. These bills are part of a package of ten bills that Chairman Ryan and other committee members introduced to change the federal budget process. As our new paper explains, these two bills would disproportionately hurt low-income people, worsen recessions, rule out balanced deficit-reduction packages, and promote deep cuts in Social Security and Medicare.

The Ryan plan would also cut Medicare in two major ways. It would gradually raise the eligibility age from 65 to 67 while repealing the health reform law’s coverage expansions, so 65- and 66-year-olds would have neither Medicare nor access to health insurance exchanges where they could buy affordable coverage. And it would replace Medicare’s guaranteed benefit with a premium support payment (voucher) that beneficiaries would use to buy coverage on their own, and the voucher wouldn’t keep pace with rising health care costs.

The bills would exacerbate economic downturns by preventing the federal government’s “automatic stabilizers” — like unemployment insurance and SNAP (food stamps) — from expanding as they are designed to do to help rejuvenate a weak economy. Also, by limiting spending but not tax cuts, the bills would effectively require that all deficit reduction come from program cuts and none from revenues, thereby precluding balanced deficit-reduction packages. And they would alter congressional budget procedures to make it easier to cut Social Security and Medicare benefits, but not to strengthen these programs’ financing by raising dedicated tax revenues.

In addition, the bills would reverse a quarter-century of bipartisan practice by subjecting basic assistance programs for the poor to automatic, across-the-board cuts. In the past, both parties have embraced the principle that automatic budget cuts to enforce budget or deficit targets should spare basic assistance programs for low-income Americans to avoid driving these Americans into (or deeper into) poverty. The House bills would repeal those protections, putting low-income programs at particular risk of deep cuts during and after recessions, when the need for them is greatest.