BEYOND THE NUMBERS

Honest taxpayers will feel the pain of Congress’ cuts in the IRS budget, new reports from National Taxpayer Advocate Nina Olson and IRS Commissioner John Koskinen confirm. As we’ve written, funding cuts in recent years have compromised taxpayer service and weakened enforcement of the nation’s tax laws. Olson warns that this year’s cuts will worsen these problems, predicting that taxpayers will likely receive the worst service from the IRS in over a decade.

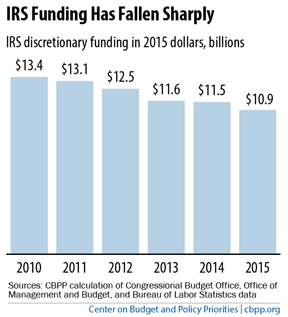

Congress has cut IRS funding sharply since 2010 (see chart), despite repeated warnings of the negative effects. Funding is 19 percent below the 2010 level and at its lowest level since 1997, after adjusting for inflation. Yet the number of tax returns filed has grown significantly, and the IRS has received major new responsibilities related to the Foreign Account Tax Compliance Act and the Affordable Care Act. In her 2014 Annual Report to Congress, released today, Olson warns that funding cuts have led to a “devastating erosion of taxpayer service, harming taxpayers individually and collectively.” The IRS will answer as few as 43 percent of taxpayers’ estimated 100 million calls this filing season, and callers will face an average wait time of at least 30 minutes. In comparison, in 2004 the IRS answered 87 percent of calls with an average wait time of less than 3 minutes. The IRS also won’t be able to respond to any taxpayer questions except “basic” ones this season, according to Olson. Similarly, Commissioner Koskinen explained in a letter to IRS employees yesterday that this year’s funding cut will delay improvements in information technology for taxpayer services and force a reduction in enforcement funding of more than $160 million. Cutting enforcement funding actually raises budget deficits by weakening tax collections. Koskinen estimates this year’s cut in enforcement funding alone will cost the federal government at least $2 billion in revenue that it otherwise would have collected. The IRS performs one of government’s most essential functions by collecting the revenue it needs to operate. Congress should stop undermining it and give it the resources it needs.