BEYOND THE NUMBERS

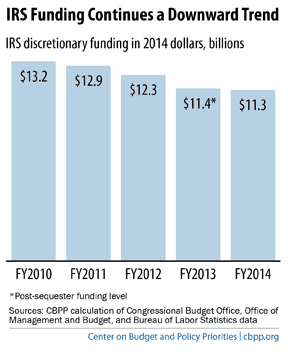

Taxpayers sitting down with their W-2s and other tax forms to prepare their tax returns shouldn’t expect much help from the IRS this year. Deep cuts to the IRS budget have forced the agency to scale back some services for taxpayers as well as enforcement efforts that generate more revenue. The IRS’s budget has taken repeated hits in recent years (see chart). Adjusted for inflation, IRS funding in 2014 is 14 percent below the 2010 level and is at its lowest level since 2000. Yet the number of tax returns filed has grown by more than 10 percent over roughly the same period.

For taxpayers, it’s a bad situation that’s growing worse. IRS statistics show that last year, millions of telephone calls to the IRS went unanswered, the average wait time for calls that were answered was 17 minutes, and nearly half of pending correspondence was delayed. IRS Commissioner John Koskinen recently warned that these trends will likely continue for this filing season, given the shrunken IRS budget. The IRS also dropped return preparation assistance at its walk-in offices this year, which it had provided for elderly, disabled, and low-income filers, and is scaling back the questions it will answer over the phone. Taxpayers increasingly are having to pay for tax preparation to comply with the law. Such privatization, according to National Taxpayer Advocate Nina Olson, “is an unprecedented change in tax administration and it is not a good one.” The budget cuts have forced the IRS to scale back enforcement efforts, as well. A large part of the agency’s budget goes to curbing tax fraud, tax evasion, and other illegal activities. These efforts provide significant bang for the buck; the Treasury Department estimates that each additional $1 spent on enforcement yields $6 in revenue. So cutting IRS funding ultimately increases deficits and debt in the long run, as we’ve pointed out before. Recent IRS data reveal some of the damage that dwindling enforcement funding has caused. In 2013, the total number of revenue agents fell to its lowest level since 2005. Unsurprisingly, the percentage of audits conducted did, too. The result: revenue from payments generated from audits uncovering additional tax liability dropped to its lowest level in nominal terms in over a decade, a point that Commissioner Koskinen underscored in his congressional testimony earlier this month. Congress continued low funding levels for enforcement in 2014 despite the fact that the recent budget deal made more funds available for appropriated programs and governmental functions — providing little help for efforts to narrow the “tax gap” and capture more of the hundreds of billions of dollars that individuals and companies owe, but fail to pay, each year. This means that those who pay their fair share of taxes must shoulder a disproportionate share of the tax burden, adding insult to injury for compliant filers who also suffer from the lack of adequate taxpayer services. As Olson has warned, “[i]n the long run, this erosion [in IRS funding] increases taxpayer burden, undermines taxpayers’ faith in the tax system, and will reduce voluntary compliance.” This fiscal squeeze on the IRS is also part of a larger problem: shrinking funding levels for non-defense discretionary programs overall. The 2011 Budget Control Act limited funding for these programs; sequestration made it even worse. Last year’s budget agreement provided relief from sequestration in 2014, but funding for non-defense discretionary programs will likely prove inadequate once again by next year, when relief from sequestration is much smaller — and certainly by 2016, when sequestration is slated to again take full effect. As the IRS example shows, starving key agencies of needed funds ultimately leads to the government being unable to deliver the basic public services that Americans expect and deserve.