BEYOND THE NUMBERS

“Ladies and gentlemen, if you tax them, they will leave,” New Jersey Governor Chris Christie told state lawmakers last year in support of his proposed tax cuts. Many elected officials, journalists, and commentators state as a truism that residents — especially wealthy ones — regularly flee from higher-tax states to lower-tax ones. Only it’s not true, as our major new report explains.

This means that states struggling in a weak economy can raise taxes on the most affluent households to invest in education, health care, transportation and other job-creating tools and not worry about it backfiring.

Here are the basic facts:

- Migration is not common. Only about 30 percent of those born in the United States change their state of residence in their lifetimes. And when people do relocate, a large body of scholarly evidence shows that they do so primarily for new jobs, cheaper housing, or a better climate.

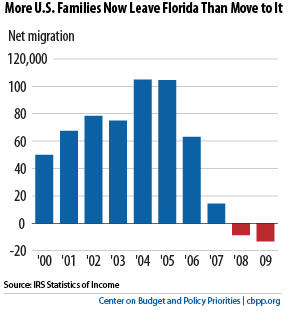

- The migration that’s occurring is much more likely to be driven by cheaper housing than by lower taxes. The difference between housing costs in two states is often many times greater than the difference in taxes. So what might look like migration in search of lower taxes is really often migration for cheaper housing.The experience in Florida, often claimed as a state that attracts households because it has no income tax, tells the tale. In the latter half of the 2000s, the previously rapid influx of people from other states into Florida slowed and then reversed. What changed wasn’t Florida’s tax policies but rather its housing prices, which rose to the point where Northeasters had fewer opportunities to “trade up” by moving to Florida after selling their expensive homes.

- Recent research shows income tax increases cause little or no interstate migration. Perhaps the most carefully designed study to date on this issue concerned the potential impact of New Jersey’s 2004 tax increase on filers with incomes exceeding $500,000. It found that at most, 70 people might have left the state between 2004 and 2007 because of the tax increase. Overall, the state gained much, much more revenue from the tax increase than it lost when these few dozen people left.Against this evidence, anti-tax advocates, policymakers, and journalists continue to rely on a few deeply flawed studies and incomplete anecdotes to back up the taxation-migration myth, as we’ll explain in a later post.

- Low taxes can prevent a state from maintaining the kinds of high-quality public services that potential migrants value. While low taxes decrease the cost of living, they also mean that states have less revenue to finance public services. The result? Fewer people will be attracted to states that have not maintained such amenities.

We’re not saying that no one ever moves to a new state in order to pay less in taxes, but the evidence clearly shows that taxes aren’t a primary motivation for migrants and that whatever tax-related migration does occur has only a minimal impact on the amount of revenue a tax increase raises. When taxes go up, the vast majority of people stay, and the state gains significant revenue for public needs.

State policymakers shouldn’t allow false claims to push them into unaffordable tax cuts or frighten them away from needed tax increases.