off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

If Sequestration Remains, Policymakers Will Have Cut Deficits by Nearly $4 Trillion, Largely Through Spending Cuts

Receive the latest news and reports from the Center

As a House-Senate conference committee on the budget resolution begins work, it’s worth taking stock of the deficit reduction of recent years.

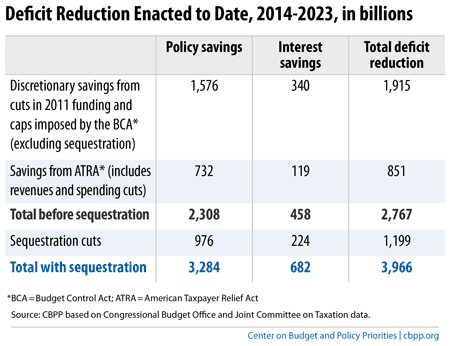

Policymakers have enacted several deficit-reduction measures since 2010, including cuts to appropriations in 2011, the 2011 Budget Control Act (BCA), and the American Taxpayer Relief Act (ATRA) in early 2013. Taken together, these measures will shrink deficits by nearly $4 trillion over the 2014-2023 period, if the sequestration cuts remain in place or policymakers replace them with comparable deficit-reduction measures over the decade (see table).

This nearly $4 trillion in deficit reduction reflects policy changes and the accompanying interest savings. It doesn’t count the effects of an improving economy or the expiration of temporary stimulus measures.

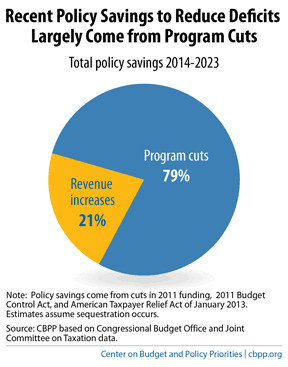

Overall, with sequestration in place, 79 percent of the deficit reduction over 2014-2023 resulting from policy changes will come from spending cuts — just 21 percent from increased revenues (see graph). Even if we replaced half of the sequestration cuts in 2014 and beyond with added revenues, nearly two-thirds of the deficit reduction achieved over the 2014-2023 period would come from spending cuts.