BEYOND THE NUMBERS

The Senate is soon expected to consider competing proposals to cut taxes on small businesses, with the goal of creating jobs. The Congressional Budget Office (CBO) has made it easy for the Senate to choose the option that’s most likely to do so. Late last year, CBO estimated how a number of tax and spending policies would affect economic growth and employment in a weak economy. It analyzed two options that are similar to the approaches of the Senate proposals.

House Majority Leader Eric Cantor (R-VA) has proposed one option, which would provide a 20 percent income tax deduction for businesses with fewer than 500 employees. In its analysis, CBO ranked this type of approach as one of the least efficient ways to encourage growth or create jobs. That’s because firms would get a tax break whether or not they hired new workers, and the tax benefits would flow disproportionately to high-income people who would spend a relatively small share of their additional income.

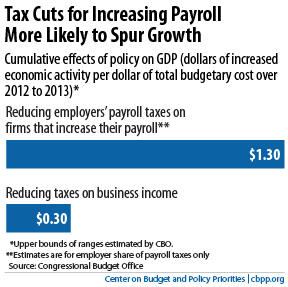

As a result, this approach would likely boost economic growth by 20 cents or less in 2012 and 10 cents or less in 2013 for every dollar of budgetary cost, and it would boost employment by two or fewer full-time-equivalent (FTE) jobs in 2012 and one or fewer FTE jobs in 2013 per $1 million of budgetary cost, CBO estimated.

The second option before the Senate, offered by Senate Democrats, would give a tax credit to only small businesses that create jobs or expand payrolls. CBO concluded that “providing tax credits for increases in payrolls would increase both output and employment” because it “would provide tax benefits linked to payroll growth; fewer budget dollars would be used to cut taxes for workers who would have been employed anyway.”

Such an approach would deliver a better bang for the buck than simply providing a tax deduction for business income with no tie to job creation. It would, CBO estimated, likely boost economic growth by between 20 cents and 80 cents in 2012 and up to 50 cents in 2013 for every dollar of budgetary cost, and it would boost employment by between two and six FTE in 2012 and between one and seven FTE in 2013 per $1 million of budgetary cost.

This chart highlights the Senate’s choice: