BEYOND THE NUMBERS

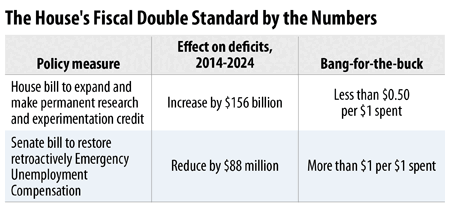

The House will vote this week to add $156 billion to budget deficits over the period 2014-2024 by expanding and making permanent the lapsed corporate tax credit for research and experimentation (R&E) without offsetting the cost. Meanwhile, House Speaker John Boehner continues to oppose legislation to restore emergency jobless benefits that lapsed in December unless “it is paid for and includes something to help create jobs.”

I addressed this fiscal double standard in my latest US News & World Report post, contrasting the House Ways and Means Committee’s passing of bills that would make permanent the R&E credit and five other lapsed corporate tax breaks with Speaker Boehner’s refusal to take up the Senate-passed emergency unemployment insurance bill.

As a low-cost temporary measure, a renewal [of jobless benefits] would add only trivially to future deficits and debt, even if it weren’t paid for — although, in fact, the Senate bill offsets the costs. The corporate tax breaks, in contrast, will do little or nothing for the recovery, while the resulting deficits will hamper economic growth for years.

…Earlier this year, when he was wearing a tax reformer’s hat and not pushing through these tax cuts, Ways and Means Committee Chairman Dave Camp, R-Mich., embraced the principle that any provisions worth having in the tax code should be offset by scaling back inefficient tax breaks elsewhere.

That’s sound long-run fiscal policy. The economic cost of borrowing to finance tax cuts typically outweighs the economic benefit of even a relatively well-regarded tax break like the credit for business research and experimentation. In contrast, scaling back an inefficient tax break ipso facto helps make the economy work better.

Extending the tax breaks without paying for them is unsound long-run economic and budget policy, and it will do little or nothing for job creation in the short run, when the economy needs stronger demand for goods and services to create jobs. On a bang-for-the-buck basis, analysts typically estimate that corporate tax breaks generate well under 50 cents of additional demand for goods and services per dollar of budgetary costs while policies like jobless benefits, which put money in the hands of people who will spend it, generate well over a dollar.

The chart below and the conclusion of my US News post sum it up:

[A] House Republican majority that says it’s all about job creation and reining in “out of control” deficits is enthusiastic about tax cuts that won’t create jobs and will make deficits worse, but it dismisses emergency jobless benefits that will create jobs and won’t make deficits worse.

Click here to read my full US News post.