BEYOND THE NUMBERS

The House Agriculture Committee is scheduled today to mark up its version of a farm bill, which would cut $16.5 billion over the next decade from the Supplemental Nutrition Assistance Program (SNAP, formerly known as food stamps) – a program that keeps millions of people out of poverty and reduces the severity of poverty for millions more.

These cuts – far deeper than those proposed under the Senate’s version of the bill – would end SNAP assistance for two to three million low-income Americans, as we explain in a new paper.

The House proposal’s SNAP cuts come mainly from eliminating a state option known as “categorical eligibility.” Congress created the option in the 1996 welfare law, allowing states to provide food assistance to households — mainly working families and seniors — with gross incomes just above the federal income limit or modest assets, but disposable income in most cases below the poverty line.

Ending categorical eligibility – which more than 40 states have adopted – would cause significant hardship across the country:

- Some 2 to 3 million people would lose their SNAP eligibility.

- Some 280,000 children in low-income families, whose eligibility for free school meals is tied to their receipt of SNAP, would lose free meals when their families lose SNAP benefits, according to the Congressional Budget Office (CBO).

- Some working families would lose access to SNAP because they own a modest car, which they often need to commute to their jobs. Specifically, these low-income working households would lose benefits simply because of the value of their modest car, forcing them to choose between owning a reliable car and receiving food assistance to help feed their families.

The bill also would eliminate SNAP incentive payments to states that have improved payment accuracy and service delivery, and it would restrict states’ use of an important paperwork simplification option (which also reduces their administrative costs).

Some policymakers, including some House Agriculture Committee members who have pushed for these SNAP cuts, have justified them mainly by charging that SNAP is growing out of control. Such charges, however, are mistaken: SNAP costs have grown substantially over the past decade, but for reasons that show the program is working.

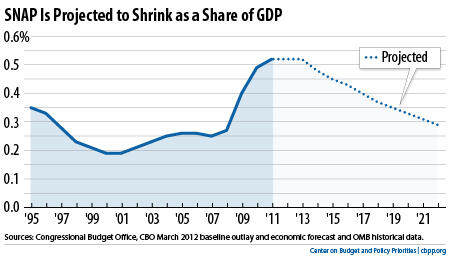

Moreover, despite the recent growth, SNAP is not contributing to the nation's long-term fiscal problems. SNAP costs will drop substantially as the economy recovers, according to CBO (see graph). By 2019, they'll fall back to their 1995 level as a share of the economy and they will grow no faster than the economy after that — the key measure of whether a program is contributing to our fiscal woes.