BEYOND THE NUMBERS

Governors across the country have released their budgets for the coming fiscal year, and while states are facing serious problems — depressed revenues, rising human needs, depleted reserves, and the end of temporary federal aid — many governors could be making much smarter choices about how to respond.

States’ basic problem remains the economy: with state tax revenues still in a deep slump due to high unemployment and weak consumer spending, states face an estimated $112 billion budget gap for the upcoming year that they have to close.

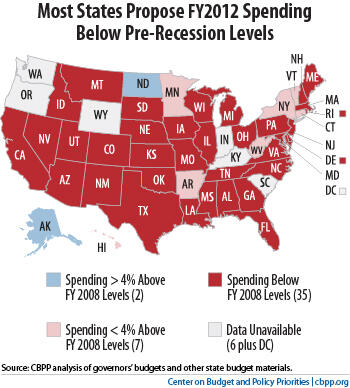

Nevertheless, our updated analysis shows that many governors’ budgets rely entirely on program cuts rather than using every tool available, like bolstering revenues and tapping any available reserves. As a result, most governors are proposing to keep spending below pre-recession levels (see map), even though states have more kids to educate and more people who need health insurance.

We’ve found the following trends:

- Most states are proposing deep cuts to core services. Only Alaska and North Dakota, where oil revenues have propped up local economies, are proposing spending growth that comes close to meeting their residents’ needs. Most other states are proposing cuts in services that threaten to undermine children’s education, low-income families’ health, and each state’s long-term prosperity.In Arizona, for example, Governor Jan Brewer has proposed eliminating health care for 100,000 people and slashing funding for public universities, which have already raised tuition significantly and eliminated a number of campuses, programs, and departments. Combined with those previous cuts, Brewer’s proposal would bring per-student state funding down to 46 percent below pre-recession levels.

- Some states are not using their rainy day funds. Eight states still have sizable rainy-day reserve funds — meant to be used exactly in times like these — but most aren’t planning to tap them next year. For example, Texas is facing a shortfall of $27 billion for the coming two-year budget period, yet the state’s initial budget proposal ignores about $5 billion likely to remain in reserves and imposes deep cuts to school and health funding.

- A few governors are making things worse by proposing tax cuts. Seven governors facing shortfalls are proposing large tax cuts, mostly for corporations, which means those states would have to enact even deeper spending cuts to balance their budgets. For example, Governor Rick Scott in Florida proposes to cut the corporate income tax nearly in half in the coming fiscal year — costing the state an estimated $459 million — and eliminate it by 2018. At the same time, Governor Scott is proposing large spending cuts in education, health care, and other areas.Fortunately, not every governor is being so shortsighted. Seven governors have proposed to raise significant new revenue to replace a portion of the taxes lost due to the recession. All of these governors are also cutting services — some deeply — but their revenue proposals reduce the spending cuts needed to balance the budget.

The budget process has now shifted to state legislatures. In states whose governors are taking a balanced approach that includes revenues, lawmakers should follow the governor’s lead. In states whose governors are proposing a cuts-only approach, legislators should address shortfalls using the full range of tools available to them. There’s too much at stake to do otherwise.