BEYOND THE NUMBERS

Today’s report from the Pew Center on the States rightly notes that “sequestration” — the across-the-board federal budget cuts scheduled to begin January 2 — has major implications for states. But it fails to make a fundamental point: the alternatives could be even worse.

If federal policymakers avoid the “fiscal cliff” (which is really more of a slope) by enacting a deficit-reduction package that lacks significant revenue, the cuts in state aid very likely would be much deeper than under sequestration. The less revenue that a deficit package includes, the more cuts it will need to achieve the necessary savings — and the harder that states and localities will probably get hit.

State and local aid constitutes 42 percent of the federal budget outside of Medicare, Social Security, defense, and interest payments. Many federal policymakers agree in broad terms that, as they seek to reduce the deficit, cuts in Social Security and Medicare that affect current beneficiaries should be limited. And policymakers might not cut defense spending below the spending caps imposed by the 2011 Budget Control Act (BCA). If the final package does indeed limit spending cuts in these areas and includes little or no revenue, state and local aid almost certainly would face very large cuts.

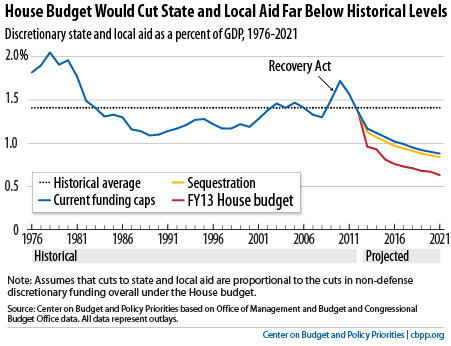

The budget that the House passed earlier this year is an example. That budget, which would shrink deficits without new revenue, would cut non-defense discretionary funding (the part of the budget that includes most state and local aid outside of Medicaid) by three times as much in 2014 as the cuts from sequestration.

Moreover, with the BCA’s spending caps, policymakers have already enacted big cuts in discretionary funding. If future policymakers meet these caps by cutting state and local aid proportionately to the cuts required in non-defense discretionary funding overall, federal funding to states and localities would reach the lowest levels in four decades as a share of the economy — even without sequestration (see graph).

Going well beyond the BCA cuts, as a cuts-focused deficit package would likely do, would amount to a huge additional cost shift from the federal government to states and localities, which are still feeling the effects of the worst recession for states in 70 years. That’s just one reason among many why federal policymakers should adopt a balanced deficit package that includes significant revenue.