BEYOND THE NUMBERS

Five Ways That States Can Produce a More Trusted and Reliable Revenue Estimate

Update, September 4: We have updated this post to reflect updates in the related revenue estimating paper.

Every state estimates how much revenue it will collect in the upcoming fiscal year. A reliable estimate is essential to building a fiscally responsible budget and sets a benchmark for how much funding the state can provide to schools and other public services. Yet, as our new report highlights, some states forecast revenues using faulty processes that leave out key players and lack transparency.

While there is no one right way to forecast revenues, research and experience suggest that states benefit from the following common-sense practices.

- The governor and legislature should jointly produce a “consensus” revenue estimate. More than half the states (28) employ such a “consensus” process. In the other 22 states and the District of Columbia, either the governor and legislature produce competing forecasts (a recipe for gridlock and political infighting) or one branch of government is left out of the official process, which may reduce the revenue estimate’s value as a trusted starting point for writing the state budget.

- The forecasting body should include outside experts. Including experts from academia or business, along with economic and budgeting experts from within the government, widens the economic knowledge available to the forecasting body and can improve how well a forecast is trusted. While more than two-thirds of the states draw on outside experts, 15 states do not.

- The forecast and its assumptions should be published and easily accessible on the Internet. Most states follow this practice, but six do not, leaving their estimates less transparent to anyone who is not directly involved in the forecasting process.

- Meetings of the forecasting body should be open to the public. In 20 states and the District of Columbia, forecasting meetings are closed to the public, unnecessarily diminishing the trust with which the forecasts might otherwise engender.

- Estimates should be revised during the budget session. Reviewing earlier estimates to adjust them for changing economic circumstances can improve their accuracy. Eleven states do not regularly review their estimates and release a revised forecast during the course of the budget session.

Together, these components create a strong, reliable revenue estimate. For example, a professional and open revenue estimating process makes revenue forecasts more transparent and accessible to the public and a broader group of legislators, which can lead to a healthier and more democratic debate and greater fiscal discipline.

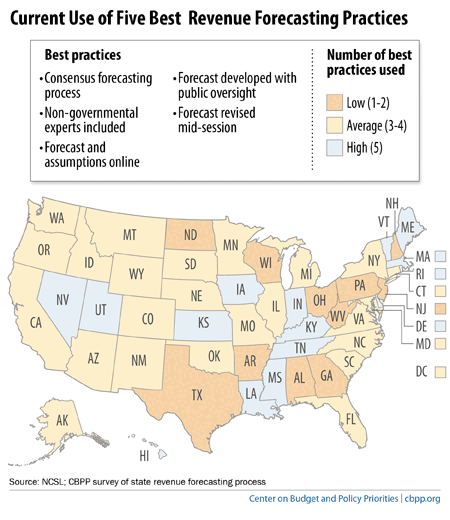

States wishing to improve their revenue estimating practices have a number of models, since many states have adopted practices that produce a more trusted forecast (see map). Fifteen states employ all five of the best practices identified by our research and can serve as models for the rest of the country. Eleven states employ only one or twoof the five best practices. These states, in particular, could benefit from adopting the better revenue estimating practices that many other states use.