BEYOND THE NUMBERS

Childless workers under age 25 are ineligible for the Earned Income Tax Credit (EITC), so young people just starting out — including low-income young men, who have disturbingly low labor force participation — receive none of its proven benefits like promoting work, reducing poverty, and supplementing low wages. Meanwhile, childless workers aged 25 and older receive just a small EITC. As a result — and unlike the members of any other group — the federal government taxes some childless workers into (or deeper into) poverty.

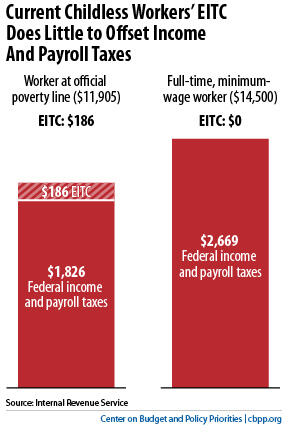

As our new paper explains and the graph shows:

- A childless adult working full time at the minimum wage (and earning $14,500) receives no EITC. This worker has a federal income and payroll tax burden of $2,669 in 2013 — a large tax burden for someone with such low wages. (This figure assumes the worker takes only the standard deduction, and it includes both the employer and employee shares of the payroll tax. Economists generally believe that employees bear the employer share in the form of lower wages, although that may not be true for minimum-wage workers. This figure falls to $1,109 if the worker pays only the employee share.)

- A childless adult with wages equal to the federal poverty line (projected at $11,905 in 2013) faces a federal tax burden of $1,826, after receiving an EITC of just $186. This worker is taxed into poverty.

Bills before the House and Senate would substantially strengthen the EITC for childless workers. Both would lower the eligibility age to 21, phase in the credit more rapidly so it fully offsets a poor worker’s payroll taxes, and raise the maximum credit from $487 to $1,350.

By rewarding work, economists believe a larger childless worker credit would encourage greater employment, much as earlier expansions of the EITC did for single mothers.

These proposals also would cut poverty among childless workers. We estimate that they would lift more than 300,000 such workers out of poverty and reduce the severity of poverty for 3.8 million others, using the Census Bureau’s Supplemental Poverty Measure — which includes the cash value of tax credits and benefit programs such as SNAP (formerly called food stamps).