BEYOND THE NUMBERS

Every state has now decided whether, under health reform, it will build and operate a state-run “exchange” — a marketplace where individuals and small businesses can compare and purchase insurance coverage — partner on an exchange with the federal government, or have the federal government operate an exchange in the state.

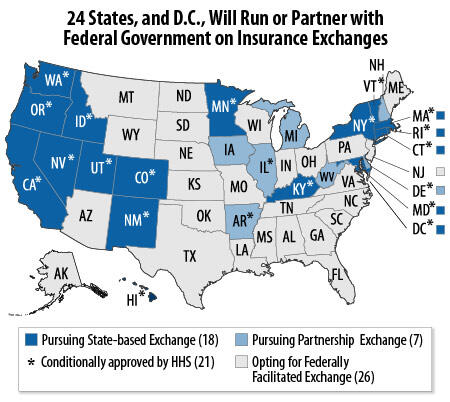

Seventeen states and Washington D.C. will go for a state-run exchange, seven states say they’ll pursue a State Partnership Exchange with the federal Department of Health and Human Services, and the remaining 26 states will let the federal government run an exchange within their borders (see map). Moving forward, however, states that opt for a federally facilitated exchange or a partnership today can transition to a fully state-run exchange in coming years.

While health care aficionados have tracked the states’ decisions closely, we shouldn’t forget that residents in all states will benefit from major improvements to the way insurance is designed and sold, regardless of whether their state runs its own exchange or has the federal government operate one. Most people without access to insurance today will be able to use these exchanges to comparison shop among a number of affordable, comprehensive coverage options. And, depending on their income, many will receive tax credits to help cover the cost of this coverage as well as assistance with co-pays and deductibles. Small businesses also can buy from these new marketplaces, offering many more choices to their employees than are available today.

People who are now covered will see upgrades to their insurance. Often, many small businesses and individuals who buy insurance today can only afford policies that skimp on coverage or place lots of financial barriers on accessing care, especially for people who are sick. In 2014, new insurance market rules will prevent insurance companies from selling products that discriminate against older people, women, and people with pre-existing health conditions. Health reform (i.e., the Affordable Care Act or ACA) also creates standards to ensure that insurance policies provide value to consumers by covering the kinds of benefits and services most people need and limiting what they have to pay out of pocket for deductibles and co-pays.

There’s lots of work left to ensure that consumers can take advantage of all of the ACA’s benefits that start next year. But residents in all states, regardless of whether their state will run its own exchange, will gain an insurance marketplace that is far more fair, transparent, and value-driven than today.