off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

Everything You Need to Know About the Budget Talks, in 11 Charts

Receive the latest news and reports from the Center

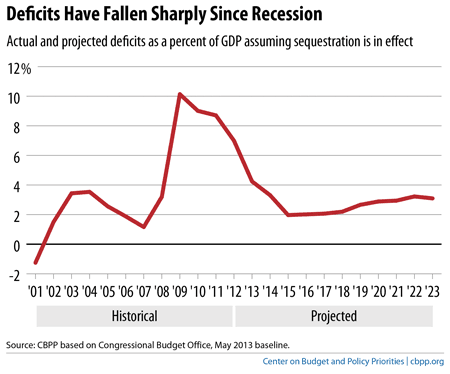

A House-Senate budget conference committee convened last week, and our new chartbook provides the context — what’s happened to deficits since the recession, why the weak economy should be part of the budget talks, what’s at stake for vulnerable Americans, how tax breaks can help reduce deficits, and how policymakers should evaluate deficit-reduction proposals. Part I below shows that deficits have dropped considerably since the recession began:

Deficits grew significantly as a share of the economy (gross domestic product, or GDP) during the Great Recession for three reasons. Federal spending rose because of “automatic stabilizer” programs such as unemployment insurance and SNAP, as well as temporary stimulus measures; tax revenues declined as individuals and businesses earned less; and GDP declined as the economy slowed.

Since 2010, deficits have been on a sharp downward path. In 2013, the deficit fell to about 4 percent of GDP. Assuming sequestration continues, by 2015 the deficit will fall to about 2 percent of GDP — less than the average of the four decades from 1969 to 2008 — and stay there through 2018. (Even if sequestration were canceled and not replaced with alternative deficit reduction, deficits over this period would be less than 3 percent of GDP.)

After 2018, deficits as a share of GDP will begin to rise modestly, but they are projected to remain below 3 percent of GDP through 2021. The aging of the population and rising health care costs will continue to place modest but consistent upward pressure on deficits and debt over subsequent decades, so longer-term deficit reduction remains important. Over the next decade, the United States does not face a “debt crisis” that endangers the economy.