BEYOND THE NUMBERS

As our new paper explains, the House Ways and Means Committee is scheduled to consider a bill this week to repeal the federal estate tax on inherited wealth, just one week after the House Budget Committee approved a budget plan calling for $5 trillion in program cuts disproportionately affecting low- and moderate-income Americans.

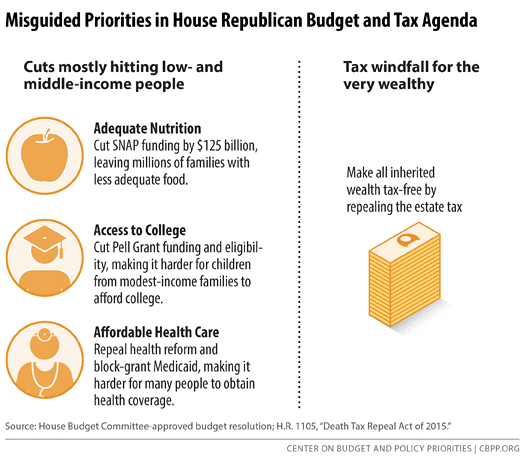

Repealing the estate tax would be highly misguided — especially in the context of the House Budget Committee plan, which would repeal health reform and cut Medicaid deeply, causing tens of millions of Americans to become uninsured or underinsured; cut the Supplemental Nutrition Assistance Program (SNAP, formerly known as food stamps), making it harder for millions of low-income families to put food on the table; and cut Pell Grants, raising the financial hurdle for people of modest means to attend college. Despite these and hundreds of billions of dollars in additional cuts that were largely unspecified, the budget included no revenue increases. And while concerns of future deficits supposedly drive the budget plan’s harsh cuts, repealing the estate tax would significantly expand deficits.

Repeal would:

- Reduce revenues by more than $250 billion over the next ten years. The legislation before the House would not offset this cost, contrary to Republican calls for a balanced budget.

- Do nothing for 99.8 percent of Americans. Only the estates of the wealthiest 0.2 percent of Americans — roughly 2 out of every 1,000 people who die — owe any estate tax. This is because of the tax’s high exemption amount, which has jumped from $650,000 in 2001 to $5.43 million per person (effectively $10.86 million for a couple) in 2015. Repeal would bestow a tax windfall averaging over $2.5 million apiece — or roughly the same amount that a typical college graduate earns in a lifetime — on the roughly 5,400 wealthy estates that will owe the tax in 2015.

- Exacerbate wealth inequality, which has grown significantly in recent decades. In 2012, the wealthiest 1 percent of American families held about 42 percent of total wealth, new data show. Large inheritances play a significant role in the concentration of wealth; inheritances account for about 40 percent of all household wealth and are extremely concentrated at the top. Repealing the estate tax would exacerbate wealth inequality by benefiting only the heirs of the country’s wealthiest estates, who also tend to have very high incomes.

In addition, despite policymakers’ frequent statements about the importance of work, repeal would reduce the incentive for heirs of large estates to work.

Evidence shows the estate tax is an economically sound tax. Contrary to claims that the estate tax hurts the economy, it likely has little or no impact on wealthy donors’ savings, and it encourages heirs to work. The estate tax is an economically efficient way to raise revenue that supports public services and lowers deficits without imposing burdens on low- and middle-income Americans. The tax plays an important role in our revenue system, particularly given our long-term budget challenges. Click here for the paper.