BEYOND THE NUMBERS

We previously showed that the Earned Income Tax Credit (EITC) for low-income workers lifts more children out of poverty than any other public program. More recent research suggests that the income assistance it provides is even better for children — our nation’s future workforce — than we thought, helping them succeed both as students and, in adulthood, as workers.

Improving school performance. For children in low-income working families, research shows that earnings supplements like the EITC can be very beneficial in times of need. As our recent paper explains, three separate teams of highly regarded researchers have found that young children in very low-income families do better in school if their families receive additional income from the EITC or (in some of the studies) similar work-based supports.

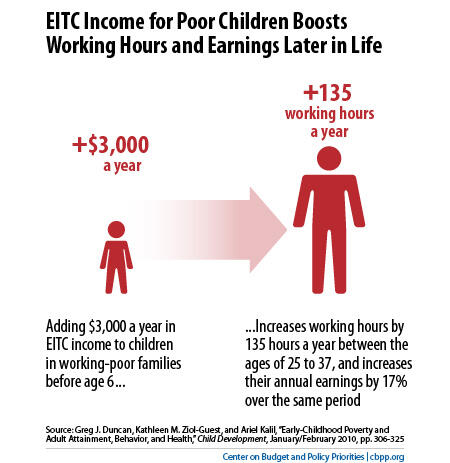

Boosting children’s work hours and earnings in adulthood. The benefits of the EITC and other income-boosting measures appear to carry over into young children’s adulthood. Two studies show that young children in low-income families that receive the type of income support that the EITC offers are likely to work more and earn more as adults.

- Raising family income through refundable tax credits (primarily the EITC) makes it more likely that children in the family will attend college and raises their earnings as adults, according to research by Raj Chetty and John N. Friedman of Harvard University and Jonah Rockoff of Columbia University. The authors conclude that “a substantial fraction of the cost of tax credits may be offset by earnings gains in the long run.”

- Children in low-income families that received an annual income boost of $3,000 (in 2005 dollars) between their prenatal year and fifth birthday earned an average of 17 percent more as adults, and worked 135 hours more annually, than similar children whose families didn’t receive the added income, according to research by Greg J. Duncan of the University of California (Irvine), Kathleen Ziol-Guest of Cornell University, and Ariel Kalil of the University of Chicago.

The additional 135 hours of work is nearly a third of the gap in adult work hours between children raised in poor families and children raised in families above twice the poverty line.

In short, the EITC boosts the work and earnings not only of single mothers, but also of their children.